Architecture de référence pour la prévision des pertes de crédit

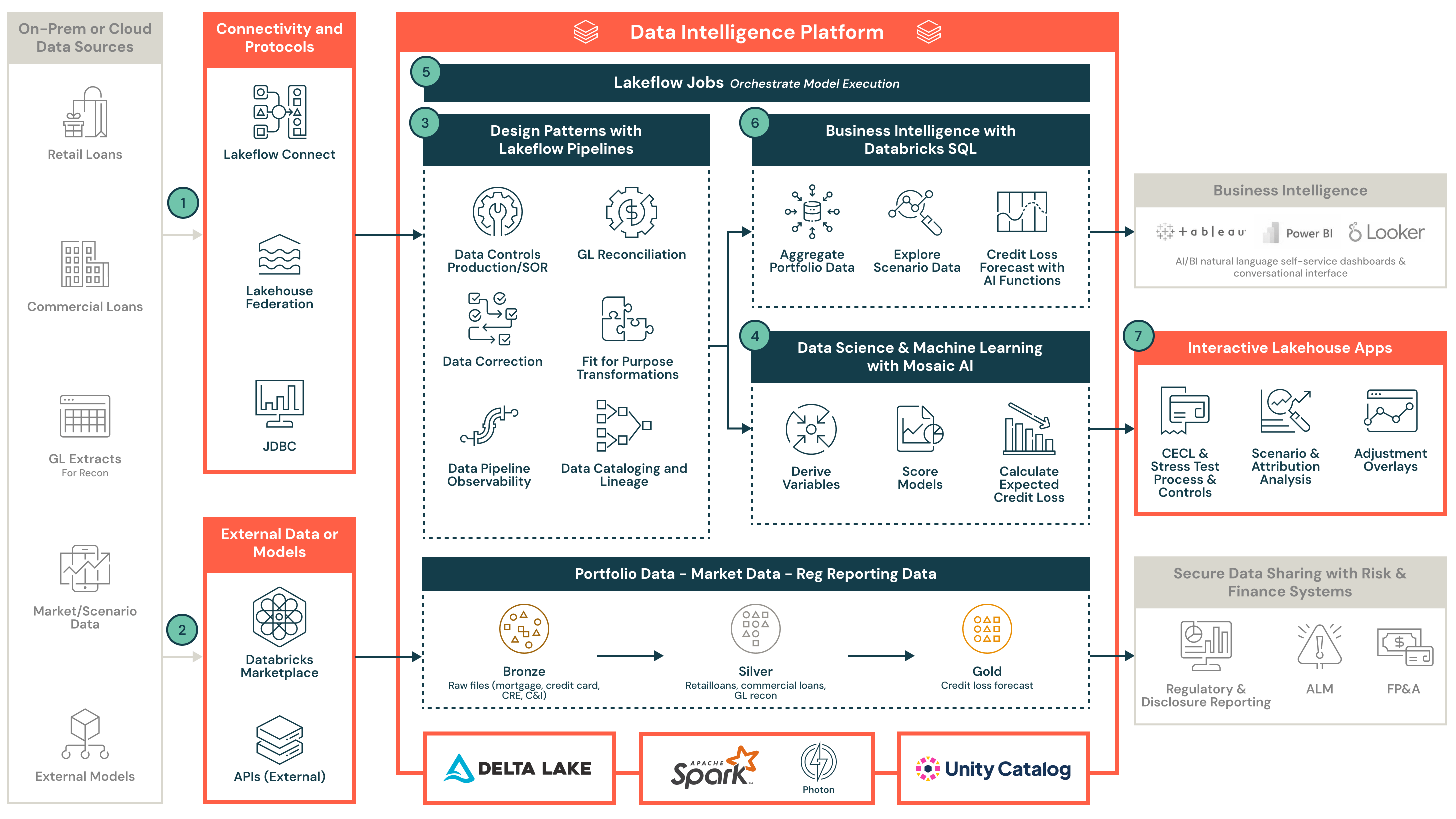

Unifiez les portefeuilles de prêts, les scénarios économiques et les modèles de risque sur la plateforme d'intelligence de données Databricks pour alimenter des tests de résistance et CECL évolutifs, transparents, audibles et rentables.

Qu'allez-vous apprendre ?

- Une architecture de lakehouse de bout en bout pour l'ingestion et l'unification des prêts de détail, des prêts commerciaux, du grand livre (GL) et des données de scénario macroéconomique

- Comment la Fédération Lakehouse et Lakeflow Connect soutiennent une intégration sécurisée, évolutive et des données à travers les systèmes cloud et sur site

- L'utilisation de lakehouse pour standardiser, réconcilier et vérifier la qualité des données pour l'exécution du modèle en aval

- Comment opérationnaliser les modèles construits en Python, R ou SAS en utilisant Mosaic AI et orchestrer les flux de travail avec Databricks Workflows

- Une couche de calcul évolutive utilisant les clusters Databricks pour supporter des tests de résistance et CECL à grande échelle

- Un catalogue centralisé de données et de modèles, un modèle de sécurité et des contrôles avec Unity Catalog pour faire respecter la lignée des données, l'auditabilité et la conformité réglementaire

- Comment les applications Lakehouse permettent une collaboration sécurisée, des ajustements et une validation des prévisions entre les équipes de risque de crédit et de finance

Modernisez votre prévision de perte de crédit pour CECL et Stress Test

- Sources de données de portefeuille et ingestion

- Accédez et ingérez des prêts de détail, des prêts commerciaux et des données d'exposition connexes

- Ingestion des données GL, y compris les comptes et les soldes impayés, pour la réconciliation et l'intégrité des données

- Utilisez Lakeflow Connect pour une ingestion native basée sur CDC à partir de systèmes de données sur site ou dans le cloud, ou utilisez Lakehouse Federation pour un accès aux données sécurisé, évolutif et sans duplication

- Données de scénario macroéconomique

- Connectez et sourcez des données de scénario macroéconomique, telles que les scénarios de Moody, via des API

- Intégrez une logique d'expansion de scénario personnalisée ou ingérez directement des ensembles de données de scénario internes dans la plateforme

- Gouvernance et gestion des données

- Utilisez Unity Catalog pour centraliser la gouvernance des métadonnées à travers les données de portefeuille, les données de scénario, les sorties de modèle, les superpositions et les rapports de divulgation. Le suivi de la lignée assure la fiabilité des données et la préparation à l'audit.

- Permettez l'intégration multi-classes d'actifs, en standardisant les données de prêt au détail et commercial avec des contrôles d'accès au niveau des lignes

- Effectuer des contrôles de qualité des données et une réconciliation GL dans des tables Silver organisées et valider les contrôles de données

- Exploitez les tables système et les pistes d'audit intégrées pour une auditabilité complète et la conformité avec les normes réglementaires

- Mettez en œuvre l'exécution du modèle

- Mettez en œuvre ou importez des modèles développés en Python, R ou SAS. Enregistrez les modèles dans MLflow.

- Définissez la logique pour la dérivation de variables, le scoring de modèle et les calculs de perte de crédit attendue (ECL) par scénario et horizon temporel

- Workflows de CECL et de test de stress

- Construire des flux de travail pour l'analyse de scénario, l'analyse de sensibilité et l'analyse d'attribution

- Exécutez des workflows à grande échelle en utilisant Databricks Workflows, fournissant automatisation, surveillance et planification pour des pipelines de modèles complexes

- Business Intelligence

- Utilisez Databricks SQL pour examiner et analyser les données de portefeuille et les données de scénario

- Effectuez une analyse de perte de crédit au niveau du prêt pour chaque scénario et horizon

- Explorez les résultats de manière interactive et validez les hypothèses avec une transparence et une traçabilité totales

- Collaboration entre le risque de crédit et la finance

- Permettre une collaboration en temps réel entre les équipes de risque de crédit et de finance via Lakehouse Apps (applications web)

- Télécharger des feuilles de calcul informatiques pour soutenir les évaluations individuelles

- Appliquez des superpositions de gestion et des contrôles de validation, et intégrez avec les systèmes de risque et de finance en aval pour l'imputation GL, les rapports de divulgation et plus encore

Avantages

- Conformité réglementaire et auditabilité

Assurez la conformité avec CECL, CCAR, IFRS 9 et d'autres cadres réglementaires grâce à la lignée de données automatisée, les contrôles intégrés et les flux de travail prêts pour l'audit - Performance évolutive pour des calculs complexes

Exécutez facilement des modèles et des scénarios de perte de crédit en utilisant l'autoscaling des clusters Databricks conçus pour des charges de travail financières nécessitant beaucoup de calculs - Architecture rentable

Tirez parti d'un modèle de tarification basé sur la consommation sans frais de licence logicielle supplémentaires — résultant en un TCO inférieur et une utilisation flexible des ressources alignée sur votre demande - Plateforme sécurisée, prête pour l'entreprise

Intégré sécurité, gestion des identités et gouvernance les capacités garantissent que les données de risque sensibles sont protégées et gérées conformément aux normes d'entreprise et réglementaires - Service en libre-service avec personnalisation complète

Permettez aux équipes internes de posséder et d'adapter leur environnement de modélisation via une plateforme en libre-service, tout en soutenant une personnalisation complète, une automatisation et une intégration avec les systèmes d'entreprise

Recommandations

Architecture sectorielle

Architecture de référence pour la gestion des investissements dans les services financiers

Architecture de référence

Entrepôt de données intelligent sur Databricks

Architecture de référence

Architecture de Référence pour l'Ingestion de Données

Architecture de référence

Architecture de bout en bout de l'Intelligence des Données avec Azure Databricks

Architecture sectorielle

Architecture de référence pour l'analytique de souscription en assurance

Architecture sectorielle

Architecture de référence pour l'optimisation de la distribution dans le secteur de l'assurance