MCP-Powered Financial AI Workflows on Databricks

Model Context Protocol and Databricks Agent Bricks power secure, real-time financial data and workflow automation.

Summary

- Discover how MCP removes integration barriers so teams can instantly access and use enterprise data, tools, and APIs within AI workflows.

- Learn how Databricks turns MCP into a governed intelligence layer where agents collaborate, reason, and act on live signals with full compliance.

- Uncover high-value use cases across trading, research, credit, underwriting, and M&A powered by agents that automate analysis and deliver real-time insights.

To understand the foundations of Model Context Protocol (MCP) and Agent Bricks, see the official launch post: Accelerate AI Development with Databricks: Discover, Govern, and Build with MCP and Agent Bricks.

Unlocking Context-Driven Financial Intelligence

Let’s be blunt: in financial services, AI doesn’t fail because models are weak. It fails at the gate, tangled in complexity and red tape. The 2024 Gartner AI Mandates for the Enterprise Survey nails the problem. A staggering 20% of institutions cite AI integration as a top-three roadblock, and 22% warn it is crippling generative AI efforts. For banks and asset managers who pride themselves on risk mitigation, this is a risk that shouldn’t exist. Yet, it is everywhere.

It is time to kill the integration tax. Engineering leaders are rallying around MCP for a reason. MCP helps teams break down silos, standardize how AI integrates with legacy infrastructure, and future-proof operations before competitors do.

MCP is not just another technical framework. When it's built on Databricks, it can help the financial industry turn AI potential into regulated, audit-ready performance at scale. With MCP, proprietary data, models, and compliance mandates finally speak the same language. This is how forward-thinking institutions will move beyond pilots, by embedding MCP into agentic, regulated workflows that actually scale in production.

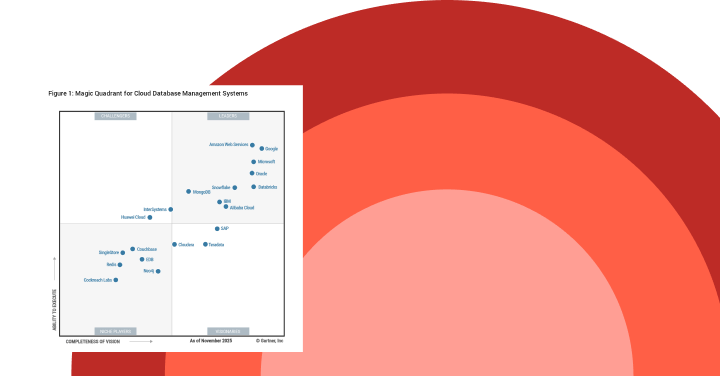

Gartner®: Databricks Cloud Database Leader

Smarter Agents, Secure Workflows

On Databricks, MCP extends what’s already possible with vector stores, document search, and data science agents by enabling these components to securely interact with external APIs and live enterprise data. Teams can build domain-aware agents that combine proprietary and external data, automating research, eliminating routine operational work, responding to market-moving events, and delivering real-time insights, all within a unified governance and compliance framework.

Through agent orchestration features like Agent Bricks’ Multi-Agent Supervisor (see the demo), Databricks empowers subject matter experts to create workflows that continuously learn, act on live signals, and produce timely, actionable intelligence at scale.

With the introduction of Agent Bricks: Multi-Agent Supervisor, Databricks enables multiple specialized agents, such as those handling sentiment analysis, document extraction, credit research, or pitch book creation, to collaborate under a single supervisory layer. This supervisor orchestrates task delegation across Genie Spaces, MCP servers, and Unity Catalog functions, synthesizing outputs from each domain to deliver more comprehensive and contextual financial insights. Teams gain the ability to execute complex, cross-functional workflows- spanning unstructured documents, market data, and analytics– with a single governed Databricks environment.

Databricks as the MCP Hub for Intelligent Workflows and Enterprise Agents

Databricks serves as the hub for MCP-powered AI workflows, unifying models, data, and tools within a governed environment. With ready-to-use MCP integration, Databricks supports managed servers, external connections, and custom deployments — all governed through Unity Catalog, which enforces permissions, lineage, and auditability across every agent interaction.

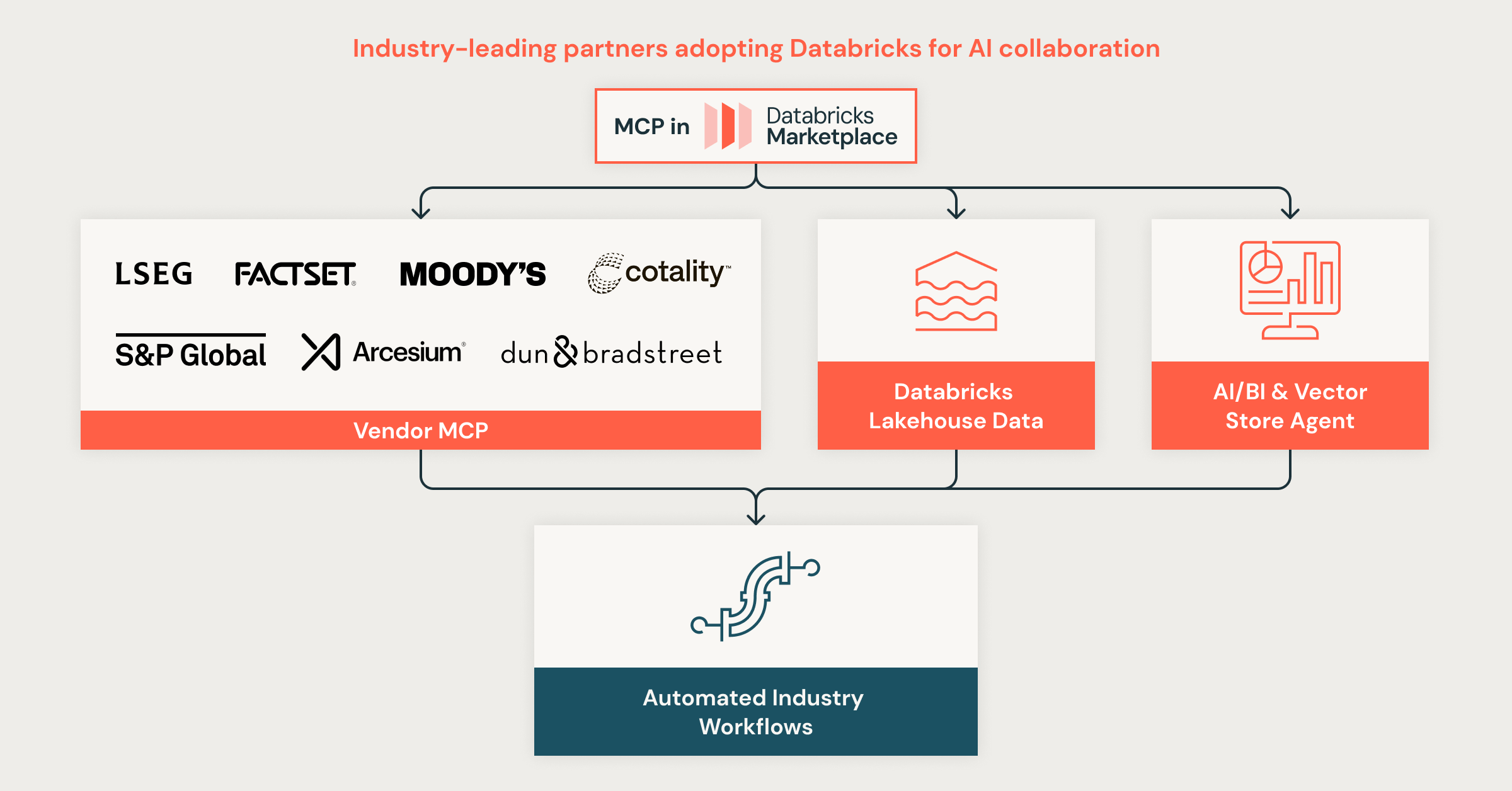

Through its open and extensible ecosystem, Databricks enables enterprises and partners to build secure, scalable AI workflows that seamlessly combine internal data, third-party APIs, and live analytics. The Databricks MCP Marketplace brings this to life — featuring leading data and analytics partners such as LSEG, FactSet, Nasdaq, Moody’s, Dun & Bradstreet, Cotality, and S&P Global Commodity Insights and Market Intelligence, and Arcesium, offering MCP services that accelerate AI adoption across Capital Markets, Banking, and Insurance.

Industry Scenarios Powered by MCP

Capital Markets

Real-Time Pricing, Curves, and Portfolio Analytics

With MCP agents integrated into Databricks, trading teams can pull live market data, pricing analytics, and curve calculations directly into real-time workflows. Instead of stitching together feeds, APIs, and spreadsheets, an agent can instantly retrieve financial instrument prices, yields, credit curves, reprice bonds or swaps, and incorporate breaking LSEG news—all through natural language. This enables intraday repricing, stress scenarios, hedging analysis, and portfolio risk checks in seconds, with results immediately ready for deeper analysis or visualization. (Learn more about LSEG MCP)

Event-Driven Research & Valuation Intelligence

Another workflow enables analysts to combine live fundamentals, earnings estimates, and management call transcripts to understand how new events or disclosures may influence valuations across an industry or peer group. By correlating this context with portfolio holdings, agents can identify exposure trends, sentiment shifts, and risk revisions to deliver faster, explainable insights for research and strategy teams. (Learn more about FactSet MCP)

Multi-Asset Fund Analysis

Using an MCP server for market data through Databricks’ AI/BI Genie (a business intelligence solution) or Unity Catalog (a streamlined governance solution), teams can pull time-series and tabular inputs, earnings trends, holdings, sector flows, and alternative signals and spot early shifts like unusual fund movements or revisions drift. Once the agent is built, Agent Bricks maps these signals to portfolio exposures, runs scenarios across macro shocks or sector moves, and estimates impacts on NAV, weights, and counterparty risk. It then generates a real-time dashboard and natural-language summary with suggested adjustments, enabling faster risk mitigation and sharper cross-asset insight within a single governed workflow. (Nasdaq Data Link MCP)

Investment Operations & Fund-Level Insights

The buy side can query its investment operations layer directly from Databricks using natural language. The agent semantically searches across fund, position, and transaction datasets, retrieves schemas, and executes live queries to analyze NAV movements, cash flows, and benchmark deviations. Results are computed in real time, enabling intraday reconciliations, liquidity checks, and operational analytics without manual data preparation or engineering.

Banking

Credit Intelligence and Portfolio Review Acceleration

A credit risk agent can give Genie Spaces secure access to current rating outlooks, credit opinions, and related research directly within Databricks. Analysts and relationship managers can query credit trends, sector shifts, or borrower-specific commentary in natural language while grounding results in governed data. This enables teams to integrate loan exposure data with the latest credit intelligence to support portfolio reviews, underwriting, and regulatory reporting. (Moody's MCP Server)

Automated Collateral & Property Risk Analysis

An MCP agent on Databricks can connect to external property, valuation, and risk data to streamline mortgage origination and portfolio management. It retrieves appraisal, flood, and hazard information to assess collateral risk, automates valuation and eligibility checks during underwriting, and continuously monitors property exposure across portfolios. (Cotality CLIP MCP)

M&A Modeling Powered by Market Data

An M&A agent can combine live commodity curves, supply forecasts, and company fundamentals to evaluate how energy market shifts affect a target’s valuation and deal economics. It pulls operational metrics, cost structures, margins, and historical performance, runs scenario analysis on crude or gas price swings, and models the impact on EBITDA, cash flow, and leverage. The agent returns a deal-ready view of sensitivities, valuation ranges, and potential risks in minutes, giving bankers the ability to shape pitches, evaluate targets, and brief clients with sharper, market-aware insights. (S&P Market Intelligence and S&P Global Commodoties MCP)

Insurance

Underwriting, Claims, and Fraud Automation

An MCP agent on Databricks integrates with external business, financial, and network data to streamline underwriting, claims, and compliance processes. It automatically retrieves firmographic profiles, ownership hierarchies, and payment behaviors to evaluate commercial risk, detect fraud, and verify counterparties during onboarding and claims handling. (D&B.AI MCP Agent-ready Data)

The Bottom Line

MCP transforms disconnected data silos and static tools into secure, intelligent, interoperable agent systems. With Databricks, every dataset, API, and model can be invoked through governed agents, empowering institutions to automate research, streamline compliance, and act on live insights—making financial operations smarter, faster, and safer.

- Watch a replay of “The Future of AI: Build Agents that Work” with Sam Altman and Ali Ghodsi.

- Watch the demo video

- Learn more about MCP on Databricks