Powering Growth: How Data and AI Are Rewiring Productivity in Banking and Payments

From Regulatory Compliance to Competitive Advantage - Why Modern Banks Are Adopting Agentic AI and Unified Data Platforms

Summary

- The Productivity Imperative: Facing fading tailwinds and stubbornly high efficiency ratios (>60%), banking leaders must "do more with less" to unlock a potential 100-150 bps lift in Return on Equity (ROE).

- Govern & Democratize Data: Only 5% of AI initiatives hit P&L goals due to structural issues; Databricks solves this by using Unity Catalog to create a unified, governed data foundation and AI/BI to democratize trusted, real-time insights to front-line bankers.

- Transform Workflows with AI: Banks earn the right to unlock step-change productivity by reimagining operations with AgentBricks, which automates complex, manual processes—from client research to execution—freeing bankers for high-value activities.

Banks are being challenged to do more with less. What’s at stake?

Today’s banks are under mounting pressure to deliver business outcomes. Interest-rate tailwinds are fading, price-to-book multiples remain compressed, and efficiency ratios remain stubbornly above 60%. At the same time, talent is scarce and competition from digital-native fintechs is intensifying. Global fintech revenues grew 21% in 2024, 3x the pace in which incumbents grew1. In this environment, banking leaders are being asked to do more with less - grow fee income in a low-rate world, make balance sheets work harder, and unlock greater productivity from leaner teams.

Since 2010, U.S. regional banks have lost roughly 30 bps of productivity each year, eroding returns even as costs rise. A single percentage point gain in productivity can lift Return on Equity (“ROE”) by 100 to 150 bps - a material swing for boards and investors.

At Databricks, we work with banking leaders worldwide across revenue and cost centers to reverse that trend. Of all banks investing in Data and AI, only about 5% of institutions have achieved measurable P&L impact. The reasons for failure are structural. Roughly 10% of initiatives fail for lack of a unified Data & AI vision, 20% due to legacy tech debt and fragmented data estates, and 70% because democratization, governance, and enablement remain unaddressed.2

The top 5 percentile of banks treat productivity loss as an opportunity to integrate data in a smarter way. They build a foundation of unified, governed data to scale intelligence, automation, and ultimately, performance.

Databricks’ approach to unlocking step-change productivity

For banking leaders already modernizing their technology and unifying their data estate, our gold-standard approach to improving productivity is two-pronged:

- Tread The Fast Path - Remove silos and outdated tools. Examine every manual step in the sales process, starting with better data governance using the power of Databricks’ Unity Catalog. Unified governance then enables you to democratize data to business users in natural language via AI/BI (Genie, Dashboards) and Databricks One. IT teams no longer remain the bottleneck between bronze/silver data and business intelligence, enabling faster and smarter decision making.

- Transform The Bank - Along the fast path, banks earn the right to reimagine & transform their operating model, unlocking step change in productivity. Using Databricks’ Agent Bricks, banks can rapidly create, evaluate, optimize AI agents on the cost-quality frontier to automate manually intensive processes, unlocking time for higher-value activities.

A day in the life of a Mid-Market Commercial Banking leader

At Databricks, we work closely with commercial banking leaders across mid-market U.S. Their mandate is to grow profitably, deploy capital efficiently, and lift banker productivity. Yet efficiency ratios remain above 60%, and relationship banker productivity has been flat for over a decade.

Headcount is leaner. Since 2020, regional banks have cut front-line teams by about 15%, even as credit demand, compliance needs, and client expectations have grown. Each relationship manager now handles larger portfolios with limited tools to prioritize clients, track activity, or focus on revenue-generating work such as new loan origination, deposit growth, and cross-selling treasury or payments products.

Pressure also comes from product teams. As banks launch new, often more complex offerings across lending, FX, or treasury management, RMs struggle to stay proficient. Training is slow, guidance fragmented, and insights trapped across siloed CRMs, spreadsheets, and product systems. The result is missed opportunities and diluted “white-glove” client service - the very differentiator relationship banking depends on.

Leaders view these challenges as structural. Data is siloed across loan systems, CRM instances, and finance, with no unified layer to govern or analyze it. Without a single, governed view of banker performance and client profitability, it’s difficult to enforce accountability or direct effort toward the highest-value opportunities.

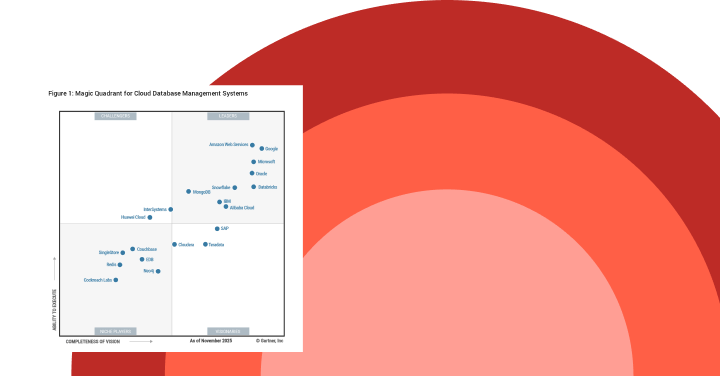

Gartner®: Databricks Cloud Database Leader

Tread The Fast Path: Govern & Democratize Your Data

For the Head of Commercial Banking, productivity is measured by pipeline volume and velocity, expense ratio, revenue growth and ultimately ROE. Databricks’ Unity Catalog enables this by giving leaders a single, governed data foundation - unifying information across loan systems, CRM, deposits, and treasury to power trusted insights at every level.

This foundation enables banking executives to use Databricks’ AI/BI Dashboards to track pipeline health and conversion rates in real time, segment portfolios by banker, client type, or region, and identify cross-sell opportunities or margin leakage - all from a single source of truth. They can also link banker activity data (calls, meetings, client touches) to performance outcomes, helping managers coach for higher-value behaviors.

For front-line bankers, Databricks One makes these insights instantly available via AI/BI Genie, Databricks Apps and real-time AI/BI dashboards. Instead of relying on manual exports or end-of-month reports, bankers can simply ask, “Which clients require deposit pricing exceptions?” or “Which renewals are at risk this quarter?” — and act on the answers immediately. The result is sharper prioritization, faster renewals, and higher wallet share.

Databricks helped a leading bank modernize its data and ML workflows, unifying client, product, and channel data on a single governed platform. Within a year, the bank achieved a 90% lift in cross-sell effectiveness and cut customer acquisition costs by over 30% — showing how unified data and AI translate directly into productivity and profit.

Transform the Bank: Reimagine workflows with AgentBricks

As leaders tread the fast path, they earn the right to unlock the next wave of productivity through agentic workflows. In addition to doing the same work faster, they can transform how bankers create value.

With Databricks’ AgentBricks, banks can orchestrate AI agents that analyze internal and external data — from FactSet, Moody’s, S&P, and Dun & Bradstreet — to prioritize actions and automate research, preparation, and outreach. For example:

- Automate research: Generate client dossiers by combining transaction history, risk signals, and market news, cutting hours of manual prep.

- Synthesize into action: Recommend products, services, or outreach messaging with human-in-the-loop review for context and compliance.

- Automate execution: Close the loop from insight to action — send client emails, approve pricing exceptions, or update systems of record automatically.

Efforts to use AI to automate manual processes is well underway across the industry. A North American bank automated client research on Databricks, reducing preparation time by 70% and expanding banker coverage without new headcount.

By simplifying technical complexity, Databricks’ Agent Bricks lets banks automate manual workflows like client research, credit memo creation or deposit pricing requests, giving bankers the capacity to engage more clients, faster and with more insight that will accelerate growth and lower operational costs.

Databricks, and our partners, are here to help

Reach out to see the “Agentic Banker” demo, built to maximize B2B seller productivity by recommending high-probability actions, automating client research, and streamlining outreach. Using Agent Bricks, Databricks customers can rapidly build AI agents that remove administrative burdens so bankers can focus on what matters most: serving their clients. If you are a global banking or payments leader looking to reimagine your operating model and unlock productivity at scale, contact us to define and execute a roadmap that turns data intelligence into measurable business performance. Together with consulting partners like Zeb, which helps banks accelerate delivery and rapidly capture value from connected, data-driven solutions, you can grow efficiently at scale on the Databricks Data and AI platform.

1 https://web-assets.bcg.com/04/4f/160d4f9d4d7e98ab417609b553d4/globalfintechreport-june2025.pdf

2 https://www.bcg.com/press/24october2024-ai-adoption-in-2024-74-of-companies-struggle-to-achieve-and-scale-value