BCBS 239 Compliance in the Age of AI: Turning Regulatory Burden into Strategic Advantage

How leading financial institutions can automate compliance, cut costs, and build real-time risk intelligence with Databricks

Summary

- Automate BCBS 239 compliance: Agent Bricks and AI/BI Genie on Databricks reduce manual effort by 90%—speeding up audits, reporting, and remediation.

- Reduce costs: Open formats and AI-driven checks save $20M–$110M annually across storage, ETL, and fines.

- Future-proof risk: One platform handles BCBS 239 today and scales for DORA, FRTB, and Basel IV.

The strategic imperative of BCBS 239 compliance

BCBS 239 (Risk Data Aggregation and Risk Reporting) has been the global standard for risk data aggregation since 2013; however, most banks still struggle to comply efficiently. McKinsey highlights that incomplete target-state data architecture and IT infrastructure are among the primary technical reasons many banks still fall short of BCBS 239 expectations.

Databricks helps compliance officers and C-suite executives automate BCBS 239 controls with AI, reduce operational costs, and future-proof for evolving regulations like DORA and Basel IV. Deloitte recommends elevating compliance projects to the board level, embedding accountability and incentivizing data ownership across both business and IT teams.

"Regulatory compliance is no longer about checking boxes. It’s about building a data-driven, AI-powered risk intelligence engine. The banks that embrace this will not just survive the next crisis, they’ll thrive in it." —Cyril Cymbler, Head of Financial Services EMEA & Strategic Customers, Databricks

This blog explores:

- Why Databricks? – How its unified, open, and AI-native architecture outperforms legacy and cloud-native alternatives.

- Why so fast? – How agentic AI and Agent Bricks accelerate compliance, reduce manual effort, and enhance decision-making.

- What’s the business impact? – Beyond regulatory checkboxes, how Databricks reduces costs, improves risk insights, and future-proofs financial institutions.

Why Databricks? The Compliance Officer’s perspective

The legacy challenge: slow, siloed, and risk-prone

Most financial institutions still rely on decades-old data warehouses (Oracle, Teradata, IBM Netezza) or first-generation cloud solutions that struggle to comply with BCBS 239’s principles:

- Manual data aggregation → High error rates, slow reporting.

- Lack of real-time processing → Inability to respond to crises swiftly.

- Fragmented governance → Difficulty ensuring data lineage, auditability, and cross-border compliance.

- High operational costs → Millions spent on ETL pipelines, data reconciliation, and regulatory fines.

- Unreliable pipelines and legacy infrastructure → Risk of missing compliance SLAs.

BCBS 239 Principle 2 (Data Architecture and IT Infrastructure) explicitly requires:

"A bank should design, build and maintain data aggregation capabilities and IT infrastructure to fully meet risk data aggregation requirements."

Legacy systems fail this test—they were not designed for modern risk aggregation at scale.

Databricks: Well-suited to support BCBS 239

ABN AMRO, one of the Netherlands’ largest banks, is already doing this on Databricks—using a governed lakehouse on Azure Databricks to modernize legacy risk data platforms, unify hundreds of data engineers, analysts, and data scientists, and accelerate regulatory reporting and advanced risk analytics into production. This real-world example shows how moving from fragmented, manual processes to a unified, AI-ready platform turns BCBS 239 compliance into a durable capability rather than a one-off project.

Databricks' unified data and AI platform helps firms address BCBS 239 principles while delivering speed, scalability, and cost efficiency. This alignment is supported by consulting best practices: Deloitte's benchmark survey finds banks with unified governance, automated workflows, and end-to-end lineage consistently outperform peers on audit readiness and adaptability.

Here’s how Databricks aligns directly with core BCBS 239 principles, turning what used to be a technical burden into an operational advantage.

BCBS 239 principle | Legacy pain | Databricks advantage |

Principle 1: Governance. Strong governance over risk data aggregation. | Manual policies, weak audit trails, data from different sources poorly governed | Centralized governance, fine-grained access control, granular audit history and monitoring, powered by Unity Catalog |

Principle 2: IT Infrastructure. Build robust data architecture and scalable infrastructure. | Rigid, batch-only processing | Lakehouse Architecture (real-time + batch, autoscaling) |

Principle 3: Accuracy. Ensure accurate, reliable aggregated risk data. | Manual reconciliation, errors, different tools | Open Table formats like Delta, Apache Iceberg™ (versioning, time travel, data quality monitoring) centralized & governed |

Principle 4: Completeness. Aggregate risk data comprehensively across organizations. | Data silos, missing records, both structured & unstructured | Federated queries (unify Oracle, Teradata, Snowflake in one view, simplified data ingestion from databases and SaaS with Lakeflow Connect) |

Principle 6: Adaptability. Flexible aggregation during stress and crises. | Slow ad hoc reporting and super rigid - too many departments involved in One reporting/dashboard release - poor level of control | Databricks SQL + Genie AI (natural language queries, instant insights) |

Principle 11: Distribution. Securely distribute reports to appropriate parties. | Static PDFs and email-based distribution take time to update and are hard to maintain | AI/BI Dashboards, API, Open Sharing (real-time, role-based access) |

Principle 13: Remedial actions. Enforce corrective measures for deficiencies promptly. | Manual fixes, slow reprocessing, workflows hard to maintain and build | Agent Bricks (AI-driven anomaly detection and auto-remediation) |

Principle 14: Home/Host cooperation. Coordinate supervisors across jurisdictions effectively, internationally. | Regional silos, compliance friction, lack of priority focus | Open APIs, formats, protocols, and Delta Sharing enable federation (secure cross-border data exchange) |

For compliance officers, working with Databricks means:

- Faster audits and regulatory reports releases (automated lineage, versioned data).

- Lower risk of fines (real-time accuracy checks).

- Facilitate and automate global open data sharing across multiple regions and legal entities.

- Reduced manual effort through AI-driven reporting enables future-proofing by being scalable for new regulations, such as DORA, FRTB, and Basel IV.

With the platform foundation in place, the next question is speed—how do we eliminate the remaining manual steps without introducing additional risk?

From unified controls to autonomous compliance: why it gets fast on Databricks

Compliance is still too manual

Even with modern data platforms, BCBS 239 compliance remains labor-intensive:

- Risk data aggregation often requires SQL experts to write complex queries.

- Anomaly detection needs manual reviews of millions of records.

- Reporting and distribution rely on static PDFs that delay insights and the decision-making process.

- Remediation is typically performed through reactive fixes after errors are identified, and pipeline replay/backfill can be expensive.

This is where agentic AI changes the game. With Databricks Agent Bricks and Databricks AI/BI Genie, you can create self-healing data pipelines that detect anomalies in real-time and auto-correct or flag issues before they reach reports. And you can query by using natural language.

Speed comparison: Databricks vs. traditional approaches

In the following chart, you will find our estimates of the time savings for every key task when deploying BCBS 239 compliance with Databricks.

For CFOs and CROs, this translates to:

- Millions saved in operational costs (fewer FTEs needed for manual checks).

- Faster regulatory responses (avoiding fines for late reporting).

- Proactive risk management (AI flags issues before they become crises).

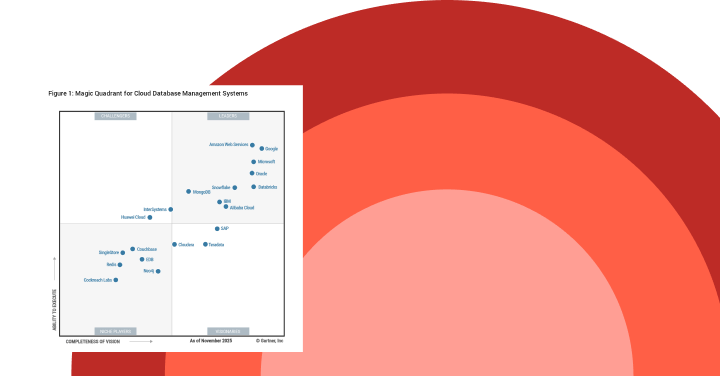

Gartner®: Databricks Cloud Database Leader

The business impact: beyond compliance, toward competitive advantage

A large European bank modernized its risk and finance stack on Databricks, consolidating fragmented risk data into a single governed lakehouse and cutting the time and cost of regulatory reporting by double digits. By reusing the same platform for advanced stress testing, liquidity risk monitoring, and front-office analytics, the bank turned a BCBS 239 remediation program into a broader data and AI transformation that now powers new revenue-generating use cases.

Cost savings: the hidden ROI of modern compliance

Financial institutions spend $50 million to $200 million annually on BCBS 239 compliance. The benefits of automation and unified data platforms are mostly connected to cost reduction and improved capital efficiency, according to McKinsey, with best-in-class banks reducing total compliance costs by 20–55%. With Databricks:

For CEOs and CFOs, this means:

- Direct cost savings (reduced cloud spend, fewer fines).

- Indirect savings (faster M&A due diligence, better capital allocation, better pricing and trading strategies).

- Reallocated budget toward AI-driven risk insights (instead of just compliance).

Risk management: from reactive to predictive

BCBS 239 is not just about reporting past risks; it’s about predicting future ones. With Databricks + Agentic AI, institutions can:

- Detect emerging risks (e.g., liquidity crunches, concentration risks) before they materialize.

- Simulate stress scenarios in real-time (not just quarterly).

- Automate regulatory responses (e.g., instant Basel III/LCR reports).

- Extend risk analytics to unstructured data.

Future-proofing: ready for DORA, FRTB, and beyond

Regulations are evolving fast:

- DORA (Digital Operational Resilience Act) mandates real-time IT risk monitoring.

- FRTB (Fundamental Review of the Trading Book) requires granular market risk data.

- Basel IV for stricter credit risk modeling.

Databricks' platform can scale for new regulations (no rip-and-replace needed). The platform also supports auditable, explainable AI-driven compliance (Agent Bricks adapts to new rules). Finally, it unifies all risk data. A data lakehouse will break all the silos between credit, market, and operational risk.

For CROs and Heads of Compliance, this means:

- No more regulatory surprises (proactive adaptation).

- One platform for all risk types (credit, market, liquidity, operational).

- AI that evolves with regulations (future-proofing compliance).

The C-suite cheat sheet: how to get started

For executives and compliance leaders, the shift to a modern, AI-driven compliance framework isn’t just about technology—it’s about strategic execution. Here’s a step-by-step cheat sheet to accelerate BCBS 239 compliance on Databricks while unlocking long-term business value.

- Assess your BCBS 239 gaps in data accuracy, speed, cost, and future readiness.

- Pilot Databricks for high-impact use cases like risk data aggregation, automated reporting, anomaly detection, and cross-border compliance.

- Scale with agentic AI for natural language queries and autonomous data validation.

Finally, make sure to measure the value generated by this implementation as well as the business impact it will have on the business.

BCBS 239 compliance as a strategic weapon

For compliance officers and C-suite executives, BCBS 239 is not just a regulatory obligation—it’s a strategic opportunity. Deloitte often states that BCBS 239 is not just a technical challenge, but also demands cultural change and data governance maturity, warning that institutions often focus on short-term fixes rather than sustainable transformation. Capgemini emphasizes the importance of integrating AI into risk data aggregation to enable proactive regulatory monitoring and automated reporting workflows.

Databricks and agentic AI deliver:

- Faster compliance (90% less manual effort).

- Lower costs ($20M–$110M annual savings).

- Better risk insights (real-time, predictive, AI-driven).

- Future-proofing (ready for DORA, FRTB, and beyond).

The choice is clear:

- If you decide to stick with legacy platforms and cloud data warehouses, you will lead to high costs, slow responses, and regulatory risk.

- Move to Databricks and new capabilities like autonomous compliance, AI-powered risk management, and a competitive edge will rise.

The question isn’t *if* you can afford to modernize—it’s *how much longer* you can afford not to.

Final thoughts

Migration is rarely straightforward. Tradeoffs, delays, and unexpected challenges are inherent to the process, particularly when aligning people, processes, and technology.

That’s why it’s essential to work with teams that’ve done this before. Databricks Professional Services and our certified migration partners bring deep experience in delivering high-quality migrations on time and at scale. Contact us to start your migration assessment.

Never miss a Databricks post

What's next?

Data Science and ML

October 1, 2024/10 min read