Actuarial Modeling Reference Architecture for Insurance

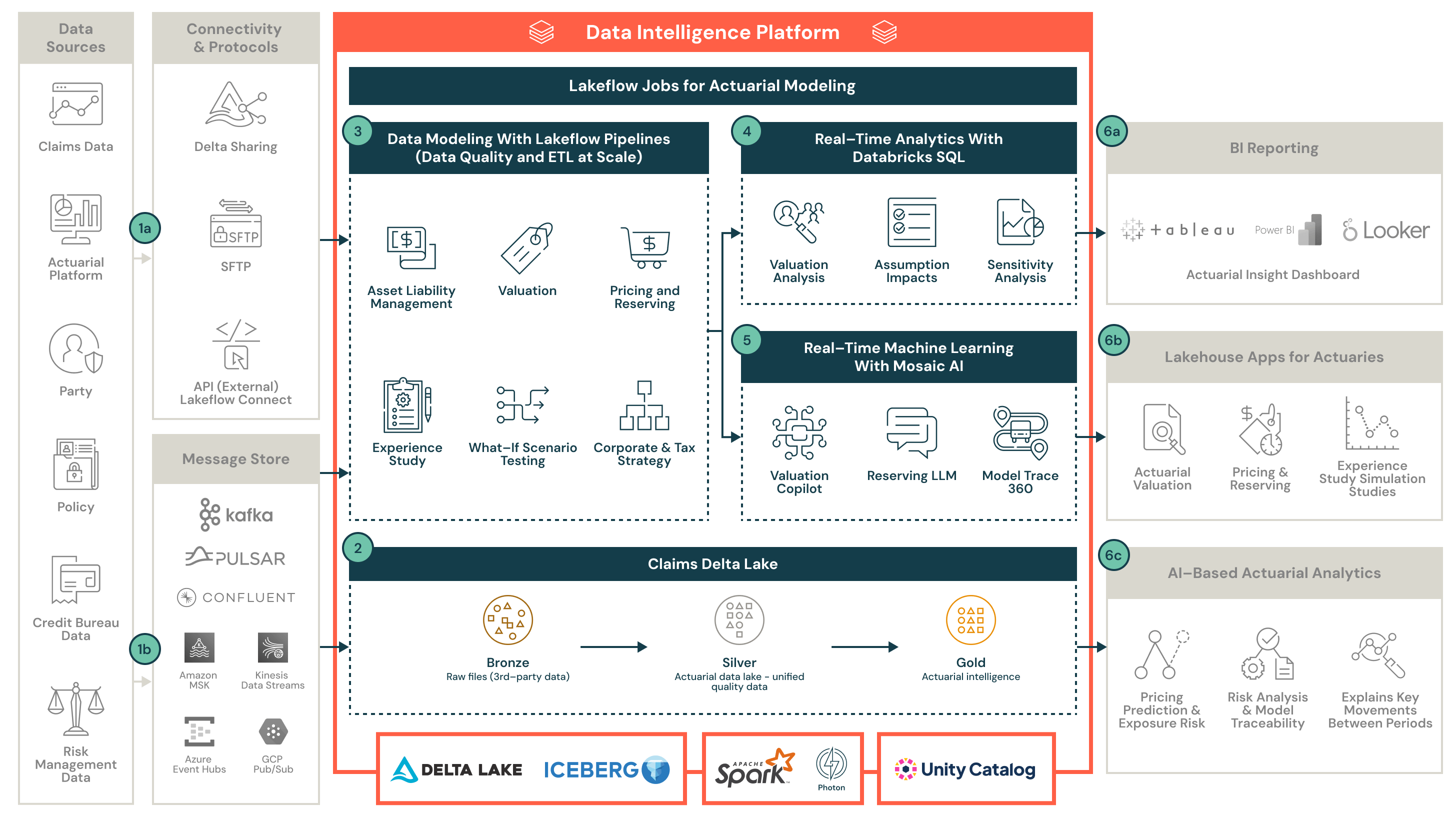

This architecture demonstrates how insurers can create a 360 view of data for effective analysis and scenario testing, leading to accurate models for use in business functions, particularly underwriting.

Data flows

The following are descriptions of the data flows shown in the actuarial modeling architecture diagram:

- Ingest enforce, claims, actuarial projections and scenario data into raw data (Bronze layer) using Lakeflow Connect and Auto Loader.

- Automatically trigger Lakeflow Jobs with data transformation pipelines — derive analytical insights via data enrichment in Spark to populate Silver and Gold layers.

- Interactively analyze insights in AI/BI dashboards or with natural language interaction in a Genie room. Rationalize any discrepancies via lineage tracing in Unity Catalog.

- Apply necessary overrides with a fit-to-task custom UI constructed in Databricks Apps.

- Serve up analytical artifacts and results via Databricks SQL to reporting systems including General Ledger.

- Optional: Share results securely with external parties such as reinsurers or parent entities.

Benefits

Benefits of using the Databricks Platform for the actuarial modeling reference architecture include the following:

- Establish best-practices architecture for actuarial modeling use cases

- Learn about AI solutions on customer 360 data and how they differentiate Databricks as the industry leader