Financial Data Intelligence: How to Transform Raw Data Into Actionable Insights

Learn how financial institutions transform raw data into actionable intelligence using analytics and AI

Financial data intelligence has become the cornerstone of competitive advantage in modern financial services. As financial institutions manage vast amounts of data from diverse sources, the challenge isn't just collecting information—it's transforming raw data into actionable intelligence that drives strategic decisions, enhances risk management, and improves customer satisfaction.

This guide explores the practical process of converting raw financial data into meaningful insights that financial professionals can use to optimize performance, reduce costs, and accelerate decision making across banking, capital markets, and insurance operations.

What is Financial Data Intelligence?

Financial data intelligence is the systematic process of collecting, analyzing, and transforming data into actionable insights that enable financial institutions to make informed decisions. Unlike basic data analysis, financial data intelligence combines advanced analytics, machine learning, and artificial intelligence to extract strategic intelligence from structured and unstructured data sources.

Key distinction: Raw data represents unprocessed information from various sources, while financial data intelligence represents the refined, contextualized insights that drive business value.

For example, transaction data becomes financial data intelligence when analytics reveal fraud patterns that achieve 90% accuracy in fraud prevention, as demonstrated by AME Digital, a fintech company operating in high-risk markets. Similarly, customer data transforms into actionable intelligence when AI models identify opportunities for 40% uplift in customer engagement impact, as achieved by Discovery Bank.

Turning Raw Financial Data Into Actionable Intelligence

The journey from raw financial data to actionable intelligence requires a structured workflow that financial services firms can implement across their operations. This process transforms unstructured data and operational data into predictive insights that enhance risk management and drive competitive advantage.

Understanding the Data Intelligence Journey: From Raw to Refined

Financial data intelligence begins with distinguishing between three critical stages: raw data collection, data analysis, and insight generation. Each stage serves a specific purpose in the workflow.

Raw data represents the unprocessed information flowing into financial institutions from multiple sources: transaction data from payment systems, customer data from CRM platforms, market data from trading systems, and alternative data from external providers. This raw information lacks context and requires significant processing before delivering value.

Data analysis applies analytical techniques to identify patterns, trends, and relationships within the data. Financial institutions use data analytics to examine historical data, detect anomalies, and generate statistical models. Advanced analytics leverage machine learning algorithms to process vast amounts of data that would be time consuming for manual analysis.

Actionable insights represent the final output: specific, contextualized intelligence that enables financial professionals to make strategic decisions. These insights answer critical business questions, such as identifying emerging threats, optimizing capital allocation, or predicting customer needs.

Leading financial institutions have demonstrated this transformation at scale. HSBC reduced complex analytics processing from 6 hours to just 6 seconds by consolidating 14 databases into a unified data architecture. This acceleration enabled real time data analysis that improved mobile banking engagement by 4.5x, with their PayMe app achieving 60% market share in Hong Kong.

Collecting and Integrating Diverse Data Sources

Financial data intelligence depends on comprehensive data collection from both internal and external sources. The financial services industry generates data across multiple systems, formats, and locations, creating integration challenges that require strategic approaches.

Internal data sources include core banking systems, payment processors, loan origination platforms, customer service records, and risk management systems. These systems often operate in silos, with each maintaining separate data stores that don't communicate effectively.

External data sources provide market intelligence through economic indicators, regulatory filings, credit bureau data, social media sentiment, and alternative data from IoT devices or satellite imagery. Analyzing customer data alongside alternative data enables financial services firms to gain better understanding of risk profiles and market shifts.

A data intelligence platform unifies these disparate sources into a cohesive architecture. Financial institutions that implement unified platforms achieve dramatic improvements: Deutsche Börse centralized 400 terabytes of daily data and streamlined over 230 pipelines, delivering 2-4x faster insights and 4-8x faster data publishing capabilities.

Integration best practices for financial data intelligence include:

- Establishing data governance frameworks that define ownership, quality standards, and access controls across all data sources

- Implementing automated data pipelines that continuously ingest, validate, and transform data from multiple systems without manual intervention

- Creating standardized data models that ensure consistency across departments and enable cross-functional analysis

- Leveraging cloud infrastructure to scale data processing capabilities as volumes grow and new data sources emerge

AXA France demonstrated the power of unified data integration by aggregating 200TB of data from 54 diverse sources, increasing data accessibility by 20x across various roles while cutting total cost of operations in half through cloud migration.

Data Preparation: Ensuring Quality and Consistency

High quality data forms the foundation of reliable financial data intelligence. Data quality issues—including incomplete records, duplicate entries, inconsistent formats, and outdated information—undermine analysis accuracy and lead to flawed strategic decisions.

Data quality management in financial services requires systematic processes to clean, validate, and standardize information before analysis. This preparation phase often consumes 60-80% of analytics project time but delivers essential benefits: consistent insights, regulatory compliance, and confidence in data driven decisions.

Financial institutions should implement these data preparation workflows:

Data profiling and assessment examines raw data to identify quality issues, understand data distributions, and establish baseline quality metrics. Automated profiling tools scan datasets to detect anomalies, missing values, and statistical outliers that require investigation.

Data cleansing corrects identified issues through standardization, deduplication, and enrichment. For example, customer records might require address standardization, phone number formatting, and duplicate account consolidation. Transaction data needs currency normalization, timestamp alignment, and category classification.

Data validation applies business rules to ensure logical consistency and completeness. Validation checks might verify that transaction amounts balance, customer ages fall within reasonable ranges, or required regulatory fields contain appropriate values. Automated validation reduces manual review burden while improving accuracy.

Data lineage tracking documents data origins, transformations, and dependencies throughout the workflow. Lineage capabilities enable financial professionals to understand how raw data became specific insights, supporting audit requirements and troubleshooting when anomalies appear.

Coastal Community Bank exemplified the impact of data quality improvements by reducing 48-hour risk and compliance processes to just 30 minutes using near real-time data. This acceleration enabled them to scale from 40,000 local customers to approximately 6 million customers served through their partner ecosystem—a 150x increase in reach.

The data preparation phase also addresses regulatory requirements around data management. Financial institutions must maintain data quality to meet compliance obligations for reporting accuracy, customer privacy protections, and audit trail documentation.

Applying Analytics and AI Models in Financial Services

Once financial institutions establish clean, integrated data foundations, they can deploy advanced analytics and AI models that extract actionable intelligence from their data assets. The choice of analytical approach depends on specific business objectives, available data characteristics, and required insight sophistication.

Choosing Analytics Approaches for Strategic Decisions

Financial data intelligence encompasses multiple analytical methodologies, each suited for different use cases within the financial services industry.

Business intelligence (BI) provides descriptive analytics that answer "what happened" questions through dashboards, reports, and visualizations. BI tools aggregate historical data to track KPIs, monitor operational data, and identify trends. These capabilities support routine monitoring and performance management but offer limited predictive power.

Machine learning enables predictive analytics that forecast future outcomes based on historical patterns. Machine learning models analyze vast amounts of data to identify complex relationships that traditional statistical methods might miss. Financial institutions use machine learning for credit scoring, fraud detection, customer churn prediction, and market forecasting.

Artificial intelligence powers prescriptive analytics that recommend specific actions to achieve desired outcomes. AI systems combine predictive models with optimization algorithms and decision logic to suggest optimal strategies. Advanced AI models support scenario planning, real-time decisioning, and autonomous operations like algorithmic trading or dynamic pricing.

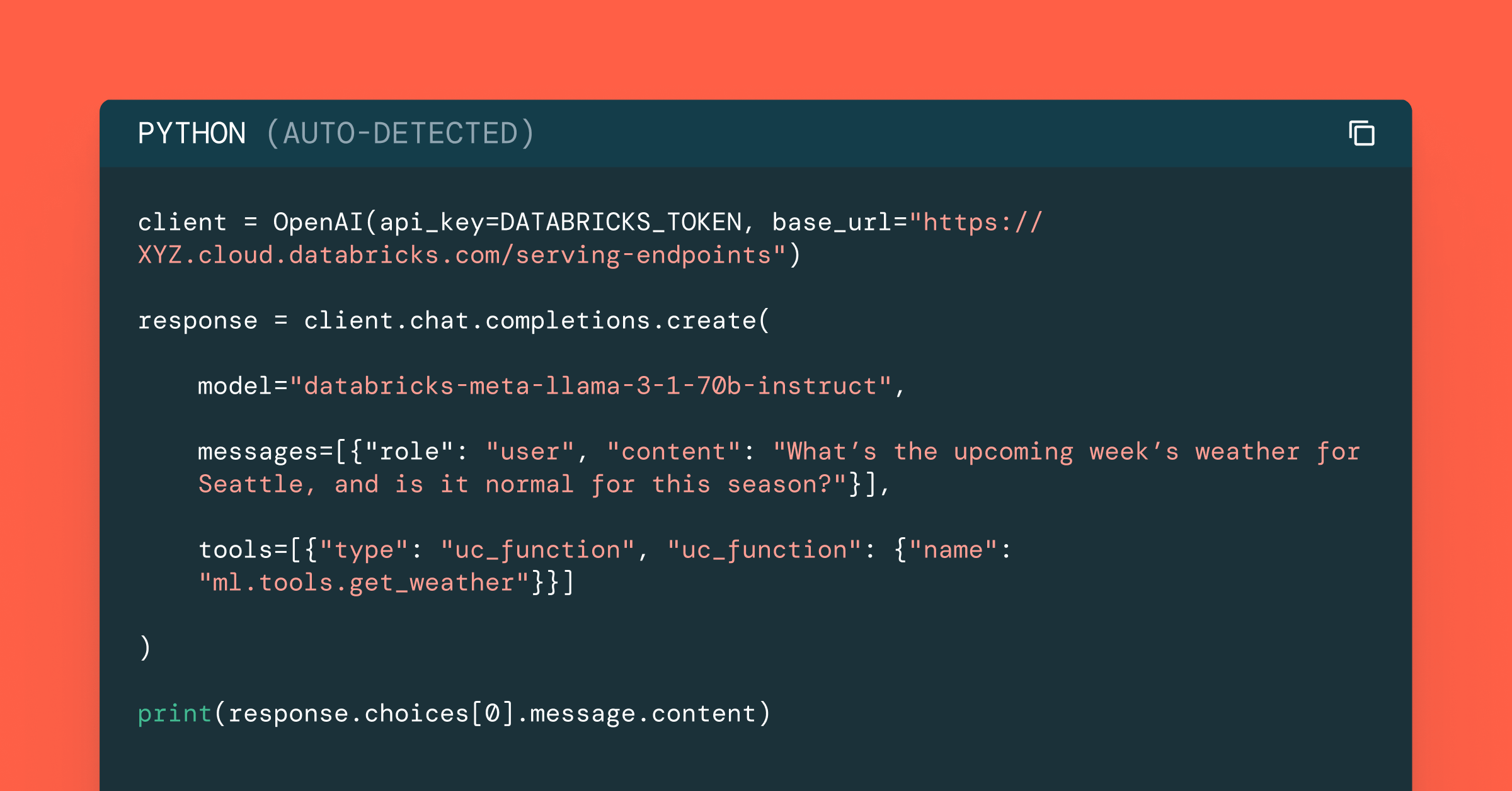

Generative AI represents the latest frontier in financial data intelligence, creating new content and insights from existing data patterns. Generative AI applications in finance include automated report generation, synthetic data creation for model testing, personalized customer communications, and intelligent chatbots for customer service.

Financial institutions increasingly combine multiple analytical approaches within integrated platforms. A comprehensive data intelligence platform provides the infrastructure to deploy various analytical techniques against unified data sets, enabling financial professionals to choose appropriate methods for each business question.

The financial services industry has seen remarkable returns from strategic analytics investments. Organizations that successfully scale AI and analytics report up to 30% higher cost savings and 50% greater productivity improvements compared to peers who don't fully leverage these capabilities.

Example: AI-Driven Risk Assessment and Fraud Prevention

Enhanced risk management through AI-driven analysis demonstrates the transformative potential of financial data intelligence. Traditional rule-based fraud prevention systems struggle with the sophisticated attack patterns that modern criminals employ, while machine learning models adapt to emerging threats continuously.

An AI-powered fraud detection workflow illustrates the practical application of financial data intelligence:

Data ingestion: The system continuously collects transaction data, customer behavior patterns, device fingerprints, and contextual information about each financial activity. This raw data flows from payment processors, mobile banking apps, ATM networks, and online banking platforms into a unified architecture.

Feature engineering: Machine learning algorithms automatically extract relevant features from raw data, identifying patterns like transaction velocity, geographic anomalies, spending deviations, and behavioral changes that might indicate fraud.

Model training: Historical data trains predictive models to distinguish legitimate transactions from fraudulent ones. The models learn from millions of labeled examples, developing sophisticated understanding of fraud patterns across different customer segments and attack vectors.

Real-time scoring: Each new transaction receives a fraud risk score within milliseconds, enabling the system to block suspicious activities before they complete. The near-instantaneous processing allows financial institutions to protect customers without disrupting legitimate transactions.

Continuous learning: The models update regularly as new fraud patterns emerge and customer behaviors evolve. This adaptive capability ensures that fraud prevention effectiveness improves over time rather than degrading as criminals change tactics.

AME Digital, a Brazilian fintech company operating in the world's second-largest fraud market, demonstrated these capabilities by achieving 90% accuracy in fraud prevention models while reducing job execution times by 85% and cutting operational costs by 34%. The system now analyzes large volumes of data in real-time to proactively block potential fraudulent transactions before they impact customers.

Similarly, Techcombank, Vietnam's largest private financial institution serving over 15.3 million customers across 315 branches, deployed 100+ machine learning risk models to strengthen fraud detection capabilities. The unified data intelligence platform enabled more sophisticated fraud detection and risk modeling while enhancing customer experience and driving business growth.

These examples demonstrate how AI models transform raw financial data into actionable intelligence that protects the firm while maintaining seamless customer experiences. The same principles apply across other risk management domains, including credit risk assessment, market risk analysis, and operational risk monitoring.

Enabling Data-Driven Decisions Across Financial Workflows

Financial data intelligence delivers maximum value when embedded directly into operational workflows where decision makers interact with insights at critical moments. Rather than generating reports that analysts review later, modern approaches put actionable intelligence at the point of decision.

Embedding Insights for Better Customer Outcomes

Financial institutions that successfully embed data-driven insights into customer-facing workflows achieve measurable improvements in satisfaction, engagement, and profitability. The key lies in making actionable intelligence available to frontline teams and automated systems at the moments when decisions occur.

Customer service optimization: Representatives with real-time access to customer intelligence can personalize interactions based on complete relationship history, predicted needs, and recommended actions. HSBC achieved 4.5x improvement in engagement by integrating data analytics across engineering, science, and analyst teams, resulting in their mobile app becoming the #1 application in Hong Kong with 60% market share.

Credit origination: Loan officers and automated decisioning systems leverage predictive models to assess credit risk more accurately than traditional scoring methods alone. By analyzing customer data alongside alternative data sources, financial institutions can extend credit to previously underserved segments while maintaining strong risk management.

Investment advisory: Wealth management platforms use customer intelligence to deliver personalized portfolio recommendations aligned with individual goals, risk tolerances, and life circumstances. Northwestern Mutual enabled personalization at scale for 10,000 advisors and millions of customers by reducing overall load time from 7 hours to 2 hours and decreasing time-to-market for new developments from 4-6 weeks to 1-2 weeks.

Compliance monitoring: Automated systems monitor transactions against regulatory requirements and internal policies, flagging potential violations for review. ABN AMRO built a platform for assessing money laundering risk in just five weeks, addressing business requests 10x faster than their legacy system while supporting 500+ data and business professionals working collaboratively.

Marketing personalization: Customer segmentation and behavioral analysis enable targeted campaigns with dramatically higher conversion rates. Raiffeisen Bank International improved multi-channel marketing performance by 60% through integrated data intelligence, deploying a GDPR-compliant system across 12 countries in just eight months.

The common thread across these applications involves transforming raw data into specific, contextual recommendations that guide decisions toward optimal outcomes. Financial professionals don't need to understand complex algorithms; they simply receive clear guidance supported by the full power of advanced analytics working behind the scenes.

Real-Time vs. Historical Data: When and Why to Use Each

Effective financial data intelligence requires understanding when to leverage real time data versus historical data. Each serves distinct purposes within comprehensive analytics strategies.

Real time data provides up-to-date information about current conditions, enabling immediate response to changing circumstances. Real-time analytics support applications requiring instant decisions:

- Fraud detection systems that block suspicious transactions within milliseconds before they complete

- Trading algorithms that respond to market moves and execute orders based on current prices and volumes

- Dynamic pricing models that adjust rates based on current demand, competition, and risk factors

- Customer engagement platforms that trigger personalized messages based on current behaviors and contexts

Financial institutions implementing real-time capabilities report significant competitive advantages. The ability to act decisively based on current information enables proactive risk management, captures time-sensitive opportunities, and delivers superior customer experiences.

Historical data reveals patterns, trends, and relationships that emerge over time. Historical analysis supports strategic planning and model development:

- Predictive models trained on historical patterns to forecast future outcomes like customer churn or market trends

- Trend analysis that identifies long-term shifts in customer behaviors, market conditions, or operational performance

- Regulatory reporting that summarizes activities over specified periods for compliance requirements

- Strategic planning that evaluates past performance to inform future business decisions and capital allocation

The most sophisticated financial data intelligence platforms seamlessly combine real-time and historical capabilities. Predictive models trained on historical data generate real-time scores for incoming transactions. Dashboards display current metrics alongside historical trends for context.

FactSet exemplified this balance by processing data 90 times faster while reducing total cost of ownership by 83%. The platform handled both real-time market data feeds and extensive historical analysis, enabling traders to make strategic decisions informed by comprehensive intelligence.

Big Book of MLOps

Overcoming Common Obstacles in Financial Data Intelligence

Despite the compelling benefits of financial data intelligence, financial institutions face significant challenges in implementation. Understanding these obstacles and proven approaches to address them accelerates successful adoption.

Data Governance and Compliance Considerations

Financial services firms operate under stringent regulatory requirements that complicate data management and analytics initiatives. Data governance frameworks balance innovation needs with compliance obligations.

Privacy regulations including GDPR, CCPA, and regional data protection laws restrict how financial institutions collect, process, and retain customer data. Organizations must implement technical controls ensuring that data analytics respect privacy rights while still enabling valuable insights. Raiffeisen Bank International deployed a GDPR-compliant system across 12 countries in just eight months that boosted marketing performance by 60%—demonstrating that governance and innovation can coexist.

Security requirements demand robust protection for sensitive financial data against unauthorized access and cyber threats. Financial institutions must encrypt data at rest and in transit, implement fine-grained access controls, maintain comprehensive audit trails, and regularly test security measures.

Regulatory reporting obligations require financial institutions to maintain data lineage, ensure data quality, and produce accurate reports for supervisory authorities. Unity Catalog provides unified governance capabilities that centralize control over structured and unstructured data, ML models, and digital assets, enabling secure collaboration while maintaining compliance across all business processes.

Data retention policies specify how long financial institutions must preserve different data types and when records should be deleted. Automated retention management ensures compliance without manual intervention, reducing legal risk and storage costs.

Financial institutions that implement comprehensive governance frameworks report multiple benefits beyond compliance. Clear data ownership accelerates decision making by eliminating confusion about authoritative sources. Consistent quality standards reduce errors that lead to poor business decisions.

National Australia Bank unlocked use cases in generative AI for customer service, marketing campaigns, and financial crime detection by implementing unified governance across the organization. The governance layer provided confidence that AI systems accessed only appropriate data while maintaining full audit trails.

Optimizing Data Quality for Consistent Insights

Data quality issues represent perhaps the most common obstacle to effective financial data intelligence. Even sophisticated analytics and AI models produce unreliable results when fed poor-quality data. Financial institutions must establish ongoing quality management practices rather than treating quality as a one-time cleanup project.

Automated quality monitoring continuously assesses data against defined standards, alerting teams when quality degrades. Quality metrics track completeness (percentage of required fields populated), accuracy (alignment with authoritative sources), consistency (conformance to defined formats), timeliness (currency of information), and validity (compliance with business rules).

Root cause analysis investigates quality issues to identify systemic problems in source systems or integration processes. Rather than repeatedly fixing symptoms, financial institutions address underlying causes that generate quality problems. For example, discovering that a particular API consistently delivers improperly formatted addresses enables fixing the integration logic once rather than cleansing data repeatedly.

Quality scorecards provide visibility into data quality across different domains, systems, and business units. Leadership can identify problem areas requiring investment and track improvement initiatives over time. Quality transparency encourages accountability and cultural shifts toward treating data as a valuable asset requiring maintenance.

Stewardship programs assign specific individuals responsibility for data quality within their domains. Data stewards define quality standards, review quality reports, approve exceptions, and coordinate remediation efforts. This accountability ensures quality receives ongoing attention rather than being perpetually deferred for urgent projects.

Continuous improvement processes embed quality enhancement into regular workflows. Teams review quality metrics during sprint planning, include quality requirements in acceptance criteria, and celebrate quality improvements alongside feature delivery. This cultural shift makes quality everyone's responsibility rather than solely a data team concern.

Financial institutions that prioritize data quality report transformative results. Better data enables more accurate predictive models, reduces costly errors in customer interactions, and accelerates regulatory reporting processes. One leading global insurance company achieved 15x uplift in fraud identification by improving data quality as part of their AI implementation, identifying an additional $34 million in incremental fraud per year.

Measuring the Impact of Financial Data Intelligence

Successful financial data intelligence initiatives deliver measurable business outcomes across multiple dimensions. Financial institutions should establish clear metrics aligning analytics investments with strategic objectives.

Cost reduction: Financial data intelligence drives efficiency through process automation, resource optimization, and waste elimination. Organizations report cost savings ranging from 34% reductions in operational expenses to 83% decreases in total cost of ownership for data infrastructure. These savings come from eliminating manual processes, optimizing infrastructure usage, and preventing losses through better risk management.

Revenue growth: Data-driven insights identify growth opportunities through better customer understanding, market intelligence, and product innovation. Financial institutions achieve revenue increases through enhanced customer engagement (40% uplift in impact), expanded market reach (150x customer growth through partner ecosystems), and improved conversion rates from personalized marketing.

Risk mitigation: Enhanced risk management capabilities prevent fraud, reduce credit losses, and ensure regulatory compliance. Financial data intelligence enables 90% accuracy in fraud prevention, identifies $34 million in incremental fraud annually, and reduces risk assessment processes from 48 hours to 30 minutes.

Operational efficiency: Accelerated processes and automated decision making improve productivity across the organization. Financial institutions report 10x faster response to business requests, 85% reductions in job execution times, and 9x performance gains in critical processes like insurance pricing models.

Customer satisfaction: Personalized experiences and faster service delivery enhance customer relationships. Data intelligence enables 4.5x improvements in engagement, 60% market share achievement, and substantial reductions in customer service response times.

Time to market: Rapid development and deployment of new capabilities accelerates competitive response. Organizations reduce time-to-market for new developments from 4-6 weeks to 1-2 weeks, enabling faster innovation cycles and quicker adaptation to market changes.

The financial services industry continues to evolve toward data-centric operating models where intelligence permeates every decision and interaction. Financial institutions that master the transformation from raw data to actionable intelligence position themselves to lead in an increasingly competitive landscape.

Frequently Asked Questions About Financial Data Intelligence

What is an example of financial intelligence?

Financial intelligence in practice includes fraud detection systems that analyze transaction patterns in real-time to prevent losses, credit scoring models that assess risk more accurately than traditional methods, personalized banking recommendations based on customer behavior analysis, and market forecasting tools that predict trends using machine learning. One notable example involves AME Digital, a fintech company achieving 90% accuracy in fraud prevention by analyzing customer data, transaction data, and behavioral patterns through AI models, resulting in 34% operational cost reduction while protecting customers.

What is the best AI for analyzing financial data?

The best AI for analyzing financial data depends on specific use cases, but comprehensive data intelligence platforms that combine multiple AI capabilities deliver superior results. Financial institutions should seek platforms offering machine learning for predictive modeling, natural language processing for document analysis, computer vision for image-based workflows, and generative AI for content creation. Unified platforms that integrate these capabilities with robust data management, governance, and security features prove most effective.

What are the 5 components of financial data analysis?

The five core components of financial data analysis include: (1) Data collection from diverse sources including transaction systems, customer databases, market feeds, and alternative data; (2) Data preparation through cleansing, validation, and transformation to ensure quality; (3) Exploratory analysis to understand patterns, trends, and relationships within the data; (4) Predictive modeling using advanced analytics and machine learning to forecast outcomes; and (5) Insight communication through visualizations, dashboards, and reports that enable data driven decisions. Successful financial data intelligence integrates all five components within unified workflows that transform raw information into strategic intelligence.

Is financial data analyst a good career?

Financial data analyst represents an excellent career path with strong growth prospects and competitive compensation. The financial services industry increasingly depends on data intelligence to drive strategic decisions, creating sustained demand for professionals who can analyze data, build predictive models, and translate insights into business value. Financial data analysts work at the intersection of finance, technology, and strategy, developing valuable skills in data analytics, machine learning, and business intelligence. The role offers opportunities to directly impact critical decisions around risk management, customer satisfaction, and competitive advantage while working with cutting-edge technologies.

Conclusion: Your Next Steps in Financial Data Intelligence

Transforming raw financial data into actionable intelligence requires a clear workflow that spans data collection, quality management, advanced analytics, and operational integration. Financial institutions that master this process achieve competitive advantage through better risk management, enhanced customer experiences, and optimized operations.

The evidence from leading financial services firms demonstrates the tangible impact: 90% fraud detection accuracy, 83% cost reductions, 40% customer engagement improvements, and 10x faster business responsiveness. These results come from systematic approaches that treat data as a strategic asset requiring continuous investment and governance.

Start by identifying a single process in your current workflow where better data intelligence would deliver immediate value—perhaps fraud prevention that's missing emerging threats, customer segmentation that lacks personalization, or risk assessment that takes too long. Apply the framework from this guide: ensure you're collecting the right data, invest in quality improvement, deploy appropriate analytics, and embed insights directly into decision workflows.

Financial data intelligence isn't just about technology—it's about building organizational capabilities that consistently convert vast amounts of information into meaningful insights that drive informed decisions. The financial institutions that excel in this transformation will define the competitive landscape for years to come.

Begin your journey toward data-driven excellence by exploring unified data and AI platforms and assessing your current capabilities against the best practices outlined here.

Additional Resources

Never miss a Databricks post

What's next?

Data Science and ML

June 12, 2024/8 min read

Mosaic AI: Build and Deploy Production-quality AI Agent Systems

Data Science and ML

October 1, 2024/5 min read