Deloitte Data as a Service for Banking: A Modern Data Solution for Banks and Capital Markets Institutions

Creating value with data through AI-enabled solutions and actionable insights for the banking, capital markets and payments sectors

As new Generative AI capabilities continue to emerge with heightened customer expectations, data modernization and migration to the cloud have become critical success factors for financial services organizations. After all, making the best use of Generative AI relies on optimized data.

Banking organizations can derive value from their data — whether it's upselling products based on a complete customer profile or real-time flagging and prevention of fraudulent activity. However, many financial institutions' data is stuck in siloed systems, and they are unable to realize its potential. It takes a broad approach to sourcing, organizing, and governing that data.

Data Modernization is Becoming an Imperative

Customer and market research indicates that data modernization has become imperative, as banks need modern banking data solutions to overcome new challenges. Over $5 billion will be spent on data initiatives in the coming years, 60% of which are on critical data modernization efforts. Unfortunately, connecting legacy systems with new data solutions can be a lengthy and error-prone process, which is why 83% of respondents prefer a prebuilt solution to handle their data challenges.*

Scalable Technology that Meets Data Modernization for Banking

Deloitte and Databricks have made it easier than ever to begin the data transformation journey with a modern, cloud-enabled solution. Deloitte's Data as a Service (DaaS) for Banking, built on the Databricks Data Intelligence Platform, aims to provide on-demand insights for banks to simplify regulatory reporting compliance, augment revenue streams, and support real-time business decisions. DaaS for Banking brings AI-enabled, pre-built frameworks and solutions to clients in a ready-to-deploy model. Instead of spending months—or even years—modernizing their data program, banking organizations can potentially be ready in weeks with curated domain-based data products to support use cases ranging from customer segmentation and behavior analytics to datasets ready for the latest AI applications.

DaaS for Banking has five modules that can be deployed based on your data needs:

- Product Attribute Listing: Start your data modernization journey with a time-tested and client-demonstrated logical data model. Widely recognized as a leader in data modernization services, Deloitte has created a domain-based logical data model of over 3,000 attributes. With pre-packaged code and Databricks, Deloitte assists with a variety of banking use cases, and enables plug and play capabilities to activate the data model across major cloud vendors.

- SmartMap: Integrate your data model with core banking systems through an automated and intelligent system that predicts logical mappings and minimizes manual work on data integration.

- ETL Engine: Engineer a robust set of data pipelines to move data across multiple layers with reduced development time and improved code quality and standardization. Thanks to proprietary machine learning (ML) models, code can be automatically built based on pre-configured mapping or customized based on specific model needs. All of this is done while maintaining transparency with an embedded ABC (audit, balance, and controls) framework.

- Smart DQ: manage your data program with a low-code interface to manage data quality rules. Our AI-enabled solution will suggest rules based on your unique datasets and either accept them, configure them, or allow you to create your own. View the health of your program's data with real-time tracking and automatically identify anomalous data with pre-built metrics and threshold reports.

- Insights Engine: Realize the power of your data with pre-built machine learning algorithms and reporting dashboards. Provide actionable insights to improve critical business outcomes, understand line-of-business performance, and analyse detailed customer data.

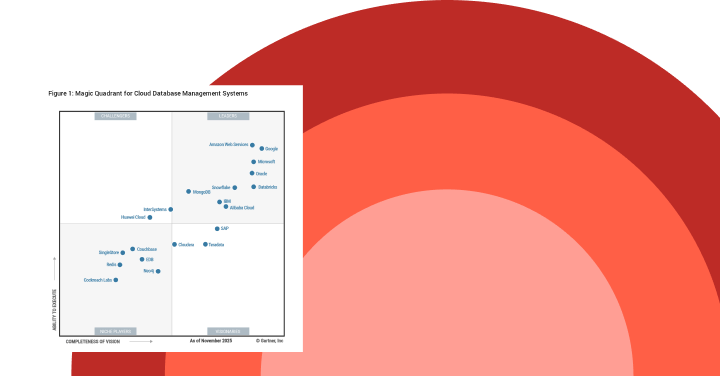

Gartner®: Databricks Cloud Database Leader

DaaS for Banking Accelerates Value

This tailored industry solution is a one-stop-shop to quickly migrate to a modern data platform on the cloud. We know that industry leaders can't wait years—or even months—to realize the value of modern data systems. DaaS for Banking can be deployed across cloud providers, enabling flexible adoption and faster time to value for business leaders.

Put into practice, a regional banking client was looking for help designing a modern data platform with an industry-specific data model and the ability to track and quality check the data pipelines as they executed jobs. After engaging Deloitte on the upfront data strategy, they hoped to build the data platform on their own, anticipating a one-year project timeline. However, the combination of Deloitte's domain experience and the pre-built capabilities of DaaS, the client realized how quickly this program could be stood up. With Deloitte's help, their program was fully operational in less than four months, a 250% increase in time to value**.

About Databricks Brickbuilder Solutions

Databricks Brickbuilder Solutions pairs the enterprise integration experience of Deloitte with the Databricks Data Intelligence Platform to offer innovative, end-to-end solutions for common industry use cases. With Brickbuilder Solutions, you get:

- A Trusted Partner: Databricks collaborates with integrators like Deloitte because of their extensive knowledge and experience across industries that can help you build and execute your lakehouse architecture strategy. Brickbuilder Solutions aim to help you solve critical analytics challenges, reduce costs, and enhance productivity with as little friction as possible.

- Credible Frameworks: Deloitte has hundreds of people trained and certified on the Databricks Data Intelligence Platform to deliver DaaS for Banking and provide the knowledge and experience needed to help you address your biggest data, analytics, and AI needs.

- Accelerated Value: Deloitte's services and pre-built frameworks help you unlock the full potential of the Databricks Data Intelligence Platform to boost productivity and extract value from data.

DaaS for Banking is Available Now

Click here to learn more about Deloitte's DaaS for Banking solution or contact Dave Hurlbrink, Deloitte Channel Sales, for more information.

For an in-depth conversation about DaaS for Banking and related client success stories, view our webinar on-demand which features industry leaders from Deloitte and Databricks detailing this comprehensive approach to data for banking.

* Market Survey Data and Deloitte Catalyst External Market Research as of 2023

** Actual savings may be based on individual facts and circumstances

This posting contains general information only, does not constitute professional advice or services, and should not be used as a basis for any decision or action that may affect your business. Deloitte shall not be responsible for any loss sustained by any person who relies on this posting.

As used in this document, "Deloitte" means Deloitte Consulting LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting.

To learn more about Deloitte's DaaS for Banking solution, we encourage you to watch this on-demand webinar: A comprehensive approach to enterprise data & AI for banks and credit unions: Dbriefs webcast | Deloitte US

Never miss a Databricks post

What's next?

Product

November 21, 2024/3 min read