Dynamic Pricing in Airlines: How AI Can Reshape Revenue Strategy

Summary

- The evolution of dynamic pricing in the airline industry

- How AI and data science shape real-time fare decisions

- What it means for revenue leaders and travelers alike

This is a collaborative post from Databricks and Celebal Technologies. We thank Bala Amavasai, Chief Technology Officer at Celebal Technologies, for his collaboration.

When Delta Airlines rolled out an AI driven pricing system, it made waves. Suddenly everyone was asking: will fares jump every time I hit refresh? Is this just code for higher ticket prices?

Even though Delta explained that the tool is intended for decision support rather than individual targeting, it drew significant attention and criticism, sparking a debate about “surveillance pricing” and the future of airfare.

This article serves as Part I of our Dynamic Pricing in Airlines series. Here, we explore the evolution and economics behind airline pricing. In Part II, we will deep dive into how the Databricks Data Intelligence Platform can help airlines modernize their pricing strategies through AI, real-time analytics, and unified data governance.

Behind the headlines the truth is airlines depend on pricing to survive. To understand why airlines lean so heavily on pricing, you first need to look at the economics of the business.

Airlines run on thin margins. Planes are costly to buy and maintain, operations are capital-intensive, and competition keeps fares tight. On top of that, airline seats are perishable inventory that has a shelf life. Once the doors close, that empty seat is gone. No clearance sales. That’s why pricing is more than just a lever for profit, it’s central to survival.

Where It All Started

Airlines didn’t invent dynamic pricing, but they were among the first to push it into modern practice. In the 1980s, after deregulation, carriers began investing in technologies that could automatically adjust fares based on demand and timing.

That was just the beginning. Over the past decade, the rise of AI and data science has completely reshaped the process. Today, automated pricing isn’t limited to airlines, it’s everywhere. Ride-hailing companies are known for using "surge pricing", which adjusts fares minute by minute based on demand. Whether for a flight, concert ticket, or rideshare, real-time pricing has become a defining feature of modern consumer experiences.

A Traveler’s Choice

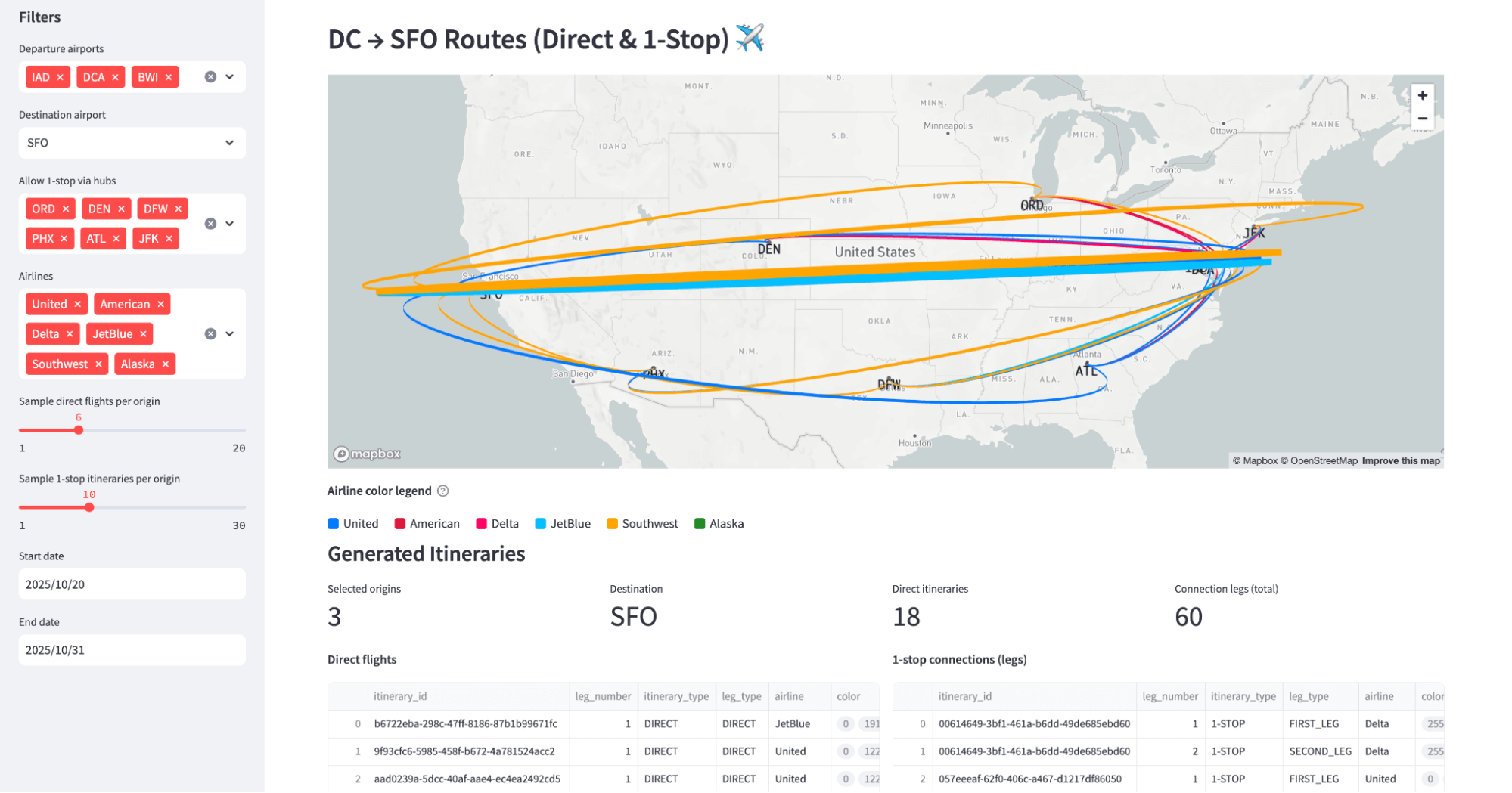

Say you’re flying from DC to San Francisco. You can go out of Dulles, Reagan, or even Baltimore airports. Each one has nonstop or connecting flight options.

If you’re traveling for business, you might pay more for a nonstop that gets you to San Francisco by midday. If it’s a vacation, you might trade some convenience for a cheaper fare.

Behind the scenes, airlines are constantly weighing these scenarios, using AI to decide what each seat is worth at any given moment.

What Airlines Optimize For

Dynamic pricing doesn’t operate in isolation, it’s tied to key performance indicators (KPIs) that airlines monitor closely:

- Load Factor: Percentage of seats filled per flight, higher load factors mean better capacity utilization.

- RASM (Revenue per Available Seat Mile): A measure of overall revenue efficiency.

- CASM (Cost per Available Seat Mile): Operating cost metric that airlines seek to minimize.

- NPS (Net Promoter Score): A gauge of customer satisfaction and loyalty, balancing pricing with passenger perception.

Successful pricing strategies strike a balance between maximizing RASM and maintaining strong customer experience scores.

Data intelligence reshapes industries

What Goes Into the Price You See

Airlines usually open bookings six to eleven months ahead. They start with a target sales curve, a rough plan for how many seats should sell at different points before departure.

AI takes that baseline and adjusts in real time, using signals such as:

- Demand: How many people are searching or booking that route?

- Competition: What are rivals charging for similar flights?

- Customer sensitivity: Do bookings hold steady if prices rise a bit, or do they drop?

- Timing: Business demand often peaks mid-week, leisure on weekends.

- Seasonality and outside factors: Weather, holidays, fuel prices, even major events.

- Digital behavior: Abandoned carts, loyalty data, and clicks that show intent.

- History: Past booking patterns and revenues captured in revenue systems and global distribution systems (GDS).

Most airlines still struggle to bring all these data signals together in one place. Many rely on legacy reservation systems, like mainframes, that were not designed for modern analytics. Add in fragmented data pipelines, strict regulatory boundaries, and it becomes incredibly hard to get a single, reliable view of demand, competition, or customer behavior. And even when the data is available, multi-hop architectures and data quality issues introduce just enough latency to make real-time pricing adjustments a challenge.

Together, these inputs create more than just a price. They create a strategy that shifts constantly, sometimes by the day, sometimes by the hour.

How Revenue Leaders See It?

For a Chief Revenue Officer (CRO) or SVP of Revenue Management, that changing fare is not just a number. It is the financial steering wheel of the airline.

Every search, every booking choice, becomes a data signal that feeds into broader decisions: is the network being monetised efficiently? Are margins being protected against rising fuel or labor costs? Is market share in strategic hubs being defended?

AI transforms these signals into intelligence that leaders can act on. The question shifts from “What price will sell this seat?” to “How does this decision affect RASM, offset CASM,improve my NPS score, and shape long-term profitability?”

This is where judgment comes in:

- Should fares be discounted to drive load factor, or held firm to protect yield?

- Should passenger and cargo pricing be balanced differently to maximize aircraft profitability?

- How fast should the airline respond when competitors optimize their fares?

AI doesn’t replace those choices. Instead, it strengthens them. It gives leaders the tools to anticipate demand, detect elasticity, and respond instantly, while still aligning every decision with broader financial objectives.

In this view, dynamic pricing is not about squeezing a few extra dollars from travellers. It’s about ensuring every flight, every route, and every market contributes to the financial health of the airline.

Looking at the Bigger Picture

Dynamic pricing isn’t about squeezing every traveler. It’s about making sure planes fly profitably while giving passengers more choice. Sometimes that means paying less if you’re flexible, sometimes it means paying more for convenience.

For airlines, AI pricing isn’t just about selling seats. It’s about keeping the business running in one of the toughest industries around. And honestly, we’re just scratching the surface.

In our next article, we will take a deep dive into the technical architecture of a dynamic pricing engine, exploring how data pipelines, AI models, and real-time decision systems work together on the Databricks Data Intelligence Platform to keep planes full and airlines profitable.

Never miss a Databricks post

What's next?

Product

November 27, 2024/6 min read

How automated workflows are revolutionizing the manufacturing industry

Healthcare & Life Sciences

December 19, 2024/5 min read