Unlocking Modern Risk & Compliance with Moody’s Risk Data Suite on the Databricks Data Intelligence Platform

How Moody’s Risk Data Suite & Databricks helps banks keep up with regulations and customer demands.

Summary

- Moody's Risk Data Suite (RDS) is now easily accessible on the Databricks Marketplace, streamlining how financial firms get crucial Moody’s Ratings.

- Integrating RDS with your existing data allows for Databrick’s AI-powered workflows in areas like credit risk management, and access credit approvals in real time.

- This collaboration helps financial firms meet evolving requirements for transparency and speed, while also boosting their competitive standing and improving customer experience.

Over the past decade, financial executives have faced a recurring challenge: new rules arrive, IT teams spin up another silo, auditors request more documentation, and fines climb ever higher when something slips through the cracks. The value of regulatory fines issued to financial institutions globally in H1 2025 more than quadrupled compared to the same period last year.

At the same time, capital buffers shift with every macro shock and change to credit profiles. Customers expect timely credit decisions and personalized pricing delivered through digital channels that legacy risk grids were never built to support.

Cloud modernization is advantageous for keeping pace with supervisory expectations and competition. Yet moving core risk and compliance workloads off mainframes has historically required painful ETL pipelines, proprietary formats and months of model-validation rework. Moody’s Risk Data Suite (RDS) is now natively available through Delta Sharing on Databricks Marketplace, giving you direct access to trusted Moody’s Ratings credit ratings. This integration streamlines your modernization efforts by enabling secure, enterprise-wide analytics and simplifying risk management, regulatory compliance, and portfolio evaluation—all on the unified, Databricks AI-powered platform.

Moody’s Data Meets the Databricks Data Intelligence Platform

Moody’s RDS delivers a trusted view of credit risk, with Moody’s Ratings credit ratings assigned to more than 10,500 corporates, financial institutions and sovereigns, plus hundreds of thousands of individual instruments, as secure, governed Delta tables. Because RDS is Delta Shared, the data lands instantly without duplication in the lakehouse with industry standard identifiers intact, ready to join with internal exposures, payments streams and ESG disclosures. Daily credit rating actions and outlook changes flow into the same tables, helping investigators, quants and finance controllers work from the most current picture of risk.

Once RDS is joined with transaction logs, sanctions lists, and earnings call transcripts, new possibilities emerge:

- Dynamic IFRS 9 and CECL provisioning becomes event-driven: when Moody’s Ratings changes an outlook, expected-loss calculations update automatically, reducing the risk of capital being over-reserved or under-reserved.

- Real-time credit decisioning on the Databricks platform blends live payments velocity with Moody’s Ratings sector outlooks to rapidly approve new-to-bank customers and adjust credit lines as macro conditions evolve.

- Scenario-driven stress testing and capital planning combine Moody’s Ratings instrument-level ratings with internal exposure data to model macro or idiosyncratic shocks in minutes. This assists risk teams with visualizing capital impacts and funding needs well before regulatory deadlines.

- Early-warning counterparty monitoring fuses Moody’s Ratings credit rating actions and outlook changes with internal exposure data to alert risk officers when a borrower’s credit profile begins to deteriorate, potentially days or even weeks before traditional triggers fire.

For example, this AI/BI dashboard offers a global view of Moody’s corporate credit landscape, showing where financial strength and credit risk concentrate across countries and industries. It visualizes long-term credit ratings, sector dispersion, and outlook sentiment to reveal stability patterns and emerging pressures on corporate credit quality worldwide.

Why This Matters Now

Regulatory agendas in Washington, London, Brussels and Singapore have converged on three themes:

- Transparency of models and data lineage – From the Basel III “end-game” capital rules to the EU’s forthcoming AI Act, supervisors appear to want airtight visibility into which data feeds each risk model, who touched the code and how the outputs are consumed. Unity Catalog and MLflow on Databricks automatically capture that lineage automatically, migrating spreadsheet archaeology that drives up compliance costs.

- Speed of risk recognition — Regulatory reporting requirements such as CECL and IFRS 9 require earlier recognition of credit deterioration, while the Fed’s CCAR scenario templates grow more granular each year. Elastic clusters let institutions run those calculations in hours, not days, potentially freeing capacity for innovation instead of batch windows.

- Responsible adoption of AI — Regulators acknowledge generative AI’s capabilities and mandate proprietary data protection and explainable model behavior. Lakeflow Jobs remain securely within licensed boundaries.

Meanwhile, customer expectations keep rising. Fintech challengers score and price credit on streaming telemetry; corporate treasurers want sustainability-linked lending tied to live ESG scores; retail clients expect approval before they click “Apply.” Bringing Moody’s RDS into the lakehouse helps incumbents meet those expectations and assists in automated decision-making backed by quality data and transparent lineage.

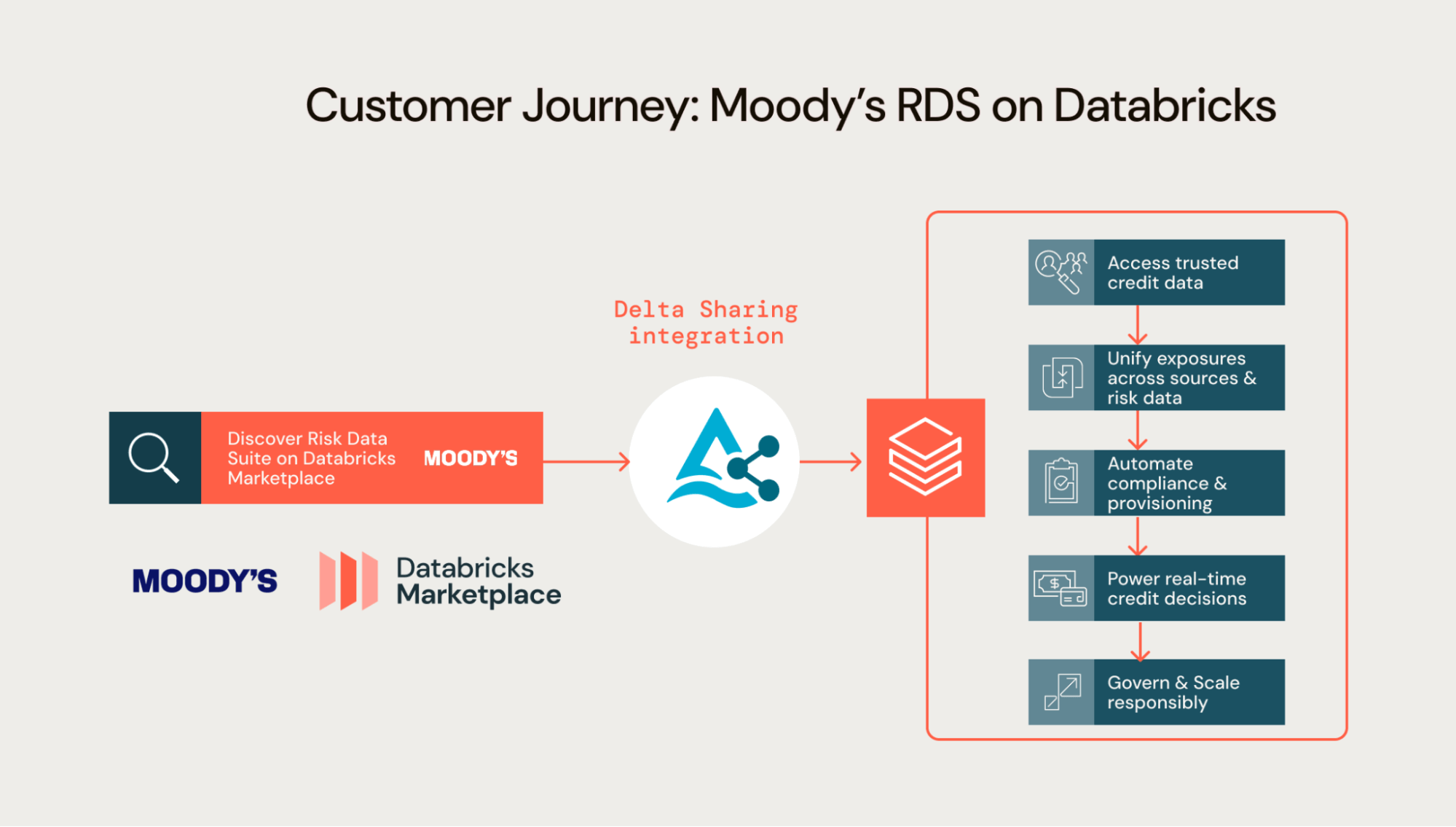

Customer Journey: Moody’s RDS on Databricks

Here’s how a typical workflow might look for a brand using Databricks and Moody’s RDS together:

1. Discover on Databricks Marketplace

Find and activate Moody’s Risk Data Suite instantly - no pipelines or setup required.

2. Access trusted credit data

Use Delta Sharing to bring Moody’s Ratings and credit risk data directly into your Databricks instance.

3. Unify exposures across sources

Join Moody’s Ratings with internal loans, payments, and ESG data for a single, governed risk view.

4. Automate compliance and provisioning

Trigger CECL, IFRS 9, and Basel models as rating actions update — cutting manual effort and delays.

5. Power real-time credit decisions

Blend live transactions and Moody’s outlooks to assess and adjust risk dynamically.

6. Govern and scale responsibly

Use Unity Catalog and MLflow for full lineage, explainability, and audit readiness.

Once authorized, Moody’s RDS from the Databricks Marketplace is activated immediately. Risk and Compliance teams can immediately query live ratings, launch notebooks, or visualize capital impacts in AI/BI dashboards, all under the same governance fabric.

By leveraging the Databricks Platform, proof points accumulate quickly: fewer escalations, faster audits, tighter capital forecasts, and higher approval rates. From there, scaling enterprise-wide is a matter of extending existing Unity Catalog policies rather than stitching together another point solution.

Wrap-Up

By bringing Moody’s Ratings and credit risk data natively into Databricks through Delta Sharing, financial institutions can replace legacy silos with a unified, governed foundation for risk intelligence. Teams gain the agility to meet regulatory expectations, respond instantly to market shifts, and deliver faster, fairer credit decisions — all while maintaining transparency, auditability, and trust across the enterprise.

Explore Moody’s Risk Data Suite on the Databricks Marketplace today and start turning tomorrow’s regulatory challenges into today’s growth opportunities.

Never miss a Databricks post

What's next?

Data Science and ML

October 1, 2024/10 min read

ICE/NYSE: Unlocking Financial Insights with a Custom Text-to-SQL Application

Product

November 27, 2024/6 min read