Distribution Optimization Reference Architecture for Insurance

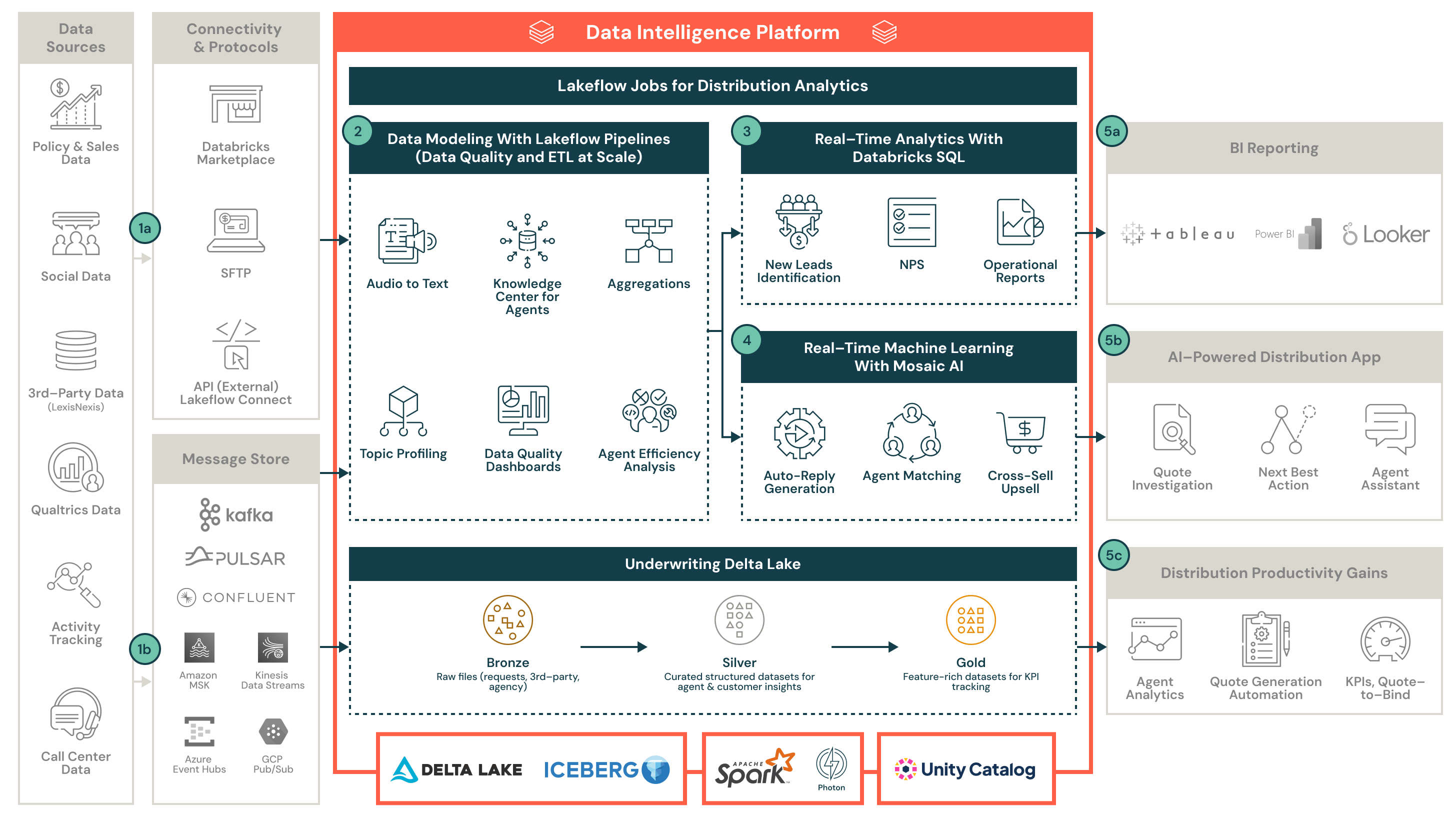

This architecture demonstrates how insurers optimize distribution using the Databricks Data Intelligence Platform to improve quote-to-bind rates and agent productivity.

Data flows

The following are descriptions of the data flows shown in the distribution optimization architecture diagram:

- Firstly, capture structured customer data from Salesforce using Lakeflow Connect with native change data capture (CDC) for real-time updates and historical tracking. Secondly, ingest policy data sources from operational systems to get agent and policy data. Use Databricks Auto Loader to ingest data into Delta Lake, organizing it through the medallion architecture (Bronze for raw CDC data, Silver for cleaned records and Gold for unified customer views).

- Build Lakeflow pipelines to transform data across layers with entity resolution, de-duplication, schema enforcement and business rule application to create accurate customer profiles.

- Leverage Databricks SQL to query curated customer data, enabling KPI dashboards, customer/agent NPS, analysis and persona-based cross-sell and upsell insights for marketing, sales and service teams.

- Train and deploy classification and predictive ML models (e.g., churn risk, upsell potential) using MLflow, integrating outputs into Gold tables for real-time decision-making.

- Develop dashboards and natural language query interfaces for business users using Databricks Apps to enable interactive, secure and personalized access to customer and agent insights for cross-sell, upsell and renewal opportunities as well as timely intervention of customer queries to prevent churn.

Benefits

Benefits of using the Databricks Platform for distribution optimization architecture include the following:

- Establish best-practices architecture for distribution optimization use cases

- Learn about AI solutions on customer profiles and how they differentiate Databricks as the industry leader

Recommended

Industry Architecture

Reference Architecture for Credit Loss Forecasting

Industry Architecture

Financial Services Investment Management Reference Architecture

Industry Architecture

Underwriting Analytics Reference Architecture for Insurance

Industry Architecture

AI-Powered Claims Assessment Reference Architecture for Insurance

Industry Architecture

Customer 360 Reference Architecture for Insurance

Industry Architecture

Actuarial Modeling Reference Architecture for Insurance

Industry Architecture

Catastrophe Modeling Reference Architecture for Insurance