Financial Services Investment Management Reference Architecture

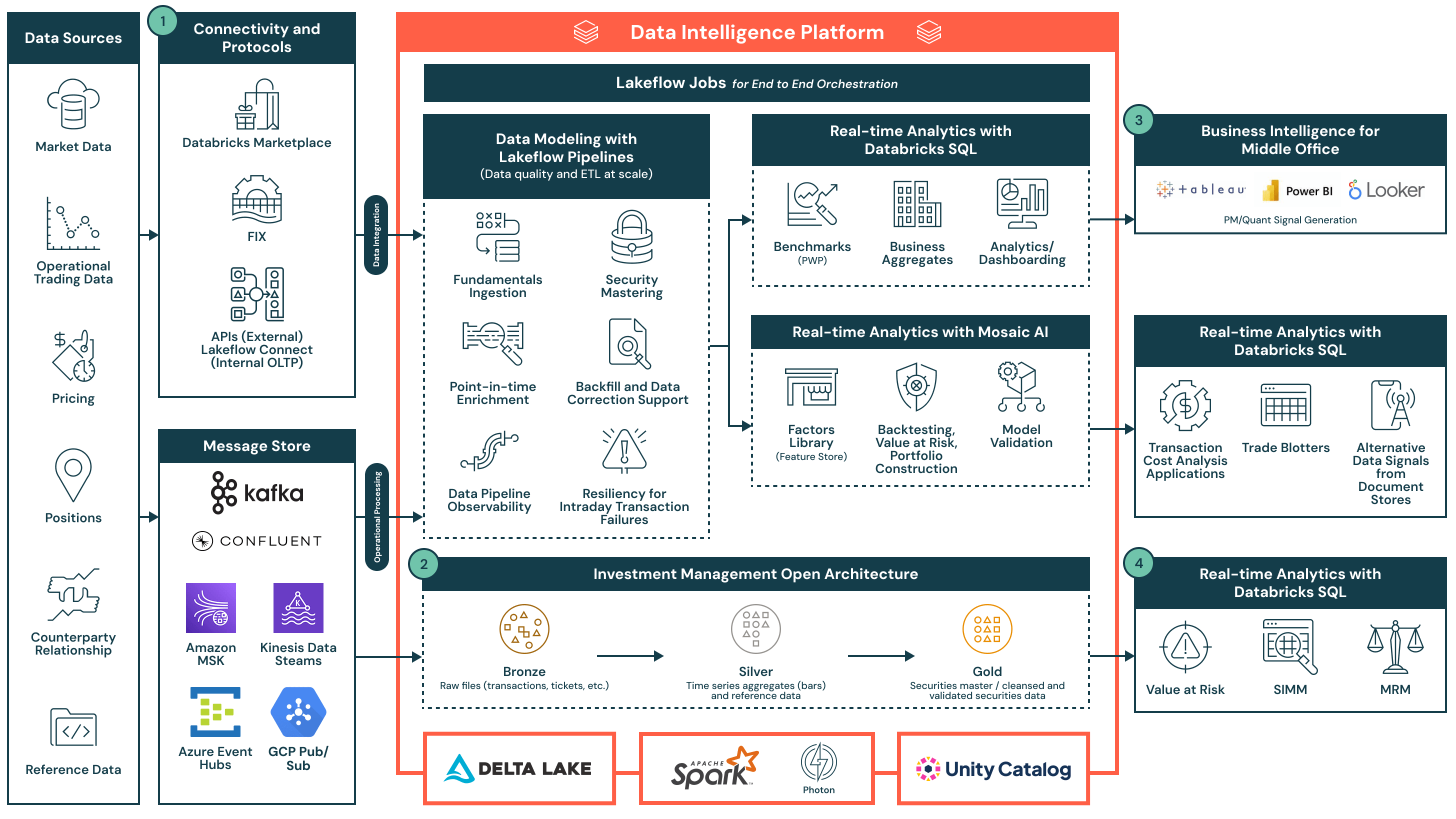

This architecture helps you understand integrations with common industry sources and sinks in capital markets. It outlines the best practice design patterns across lakehouse architecture.

What you’ll learn

- How to integrate market data, internal positions data and reference data sources into a security master and data model for trading purposes

- How to transform data into time series aggregates and apply data quality to market sources

- How to connect BI tools to your Gold layer data for serving post-trade analytics applications

- How to set the foundation for backtesting and factor analyses

Establish your market data hub for backtesting and analytics

- Data sources and ingestion

- Market data feeds: Bloomberg B-PIPE, LSEG, ICE Data Services, FactSet and Morningstar deliver real-time and historical pricing, corporate actions and fundamentals. Databricks Marketplace is the default ingestion pattern with API and file-based data delivery methods complementing Databricks connectors.

- Transaction and order management systems (OMS/EMS): Charles River, Aladdin, FlexTrade and Fidessa generate execution, allocation and position data

- Alternative data sources: Satellite imagery, credit card transactions, ESG scores and NLP-driven sentiment from news and filings are ingested for alpha discovery

- Lakeflow Connect: Native connectivity for CDC-based ingestion from portfolio accounting systems, risk platforms and fund administration systems

- Data governance and management

- Enterprisewide data catalog: Unity Catalog centralizes metadata governance across investment books of record, risk datasets and factor models, with lineage tracking for compliance

- Multi-asset class integration: Standardizing securities reference data across equities, fixed income, FX, derivatives and private assets with golden source synchronization

- System tables and auditability: Embedded audit trails for regulatory compliance with SEC, FINRA, MiFID II and Basel III

- Analytics and decision support

- Portfolio risk and performance analytics: Calculations of value at risk (VaR), stress testing, factor exposures, Sharpe ratios and attribution analytics leveraging Gold-layer Delta tables

- Quantitative and AI models: Multifactor models, mean-variance optimization and ML-driven sentiment scoring via Databricks Mosaic AI and Model Serving

- Databricks SQL warehouse: High-performance querying for trading cost analysis, liquidity modeling and pre-trade/post-trade analytics, with direct integrations into Tableau and Power BI

- Investment and trading workflows

- Pre-trade compliance and surveillance: Continuous monitoring for trade restrictions (e.g., restricted lists, position limits, wash sales) with real-time exception handling

- Trade execution and post-trade matching: Stream processing of FIX messages via DLT, reconciling fills against OMS/EMS and custodian data

- Alternative execution strategies: Backtesting and simulation of VWAP, TWAP, Iceberg and dark pool routing algorithms using historical trade and order book data

- Secure distribution and access control: Role-based entitlements for institutional clients, ensuring segmented fund-level data access across mandates

Recommended

Industry Architecture

Reference Architecture for Credit Loss Forecasting

Industry Architecture

Digital Supply Chain Reference Architecture for Manufacturing

Industry Architecture

Telecom Next Best Action Reference Architecture

Industry Architecture

Distribution Optimization Reference Architecture for Insurance

Industry Architecture

Underwriting Analytics Reference Architecture for Insurance