Shifting to Financial Intelligence: Financial Services at the Data + AI Summit 2025

How AI and Data Are Powering Real Results Across Banking, Insurance, and Capital Markets—And Why Leading Firms Are Moving Fast

Summary

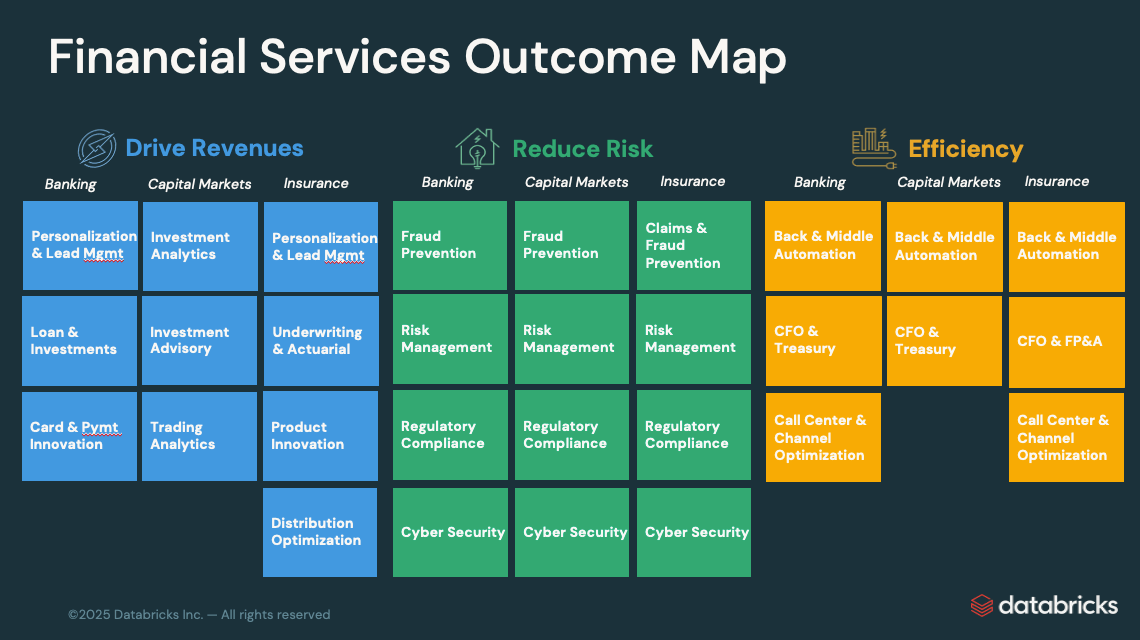

- AI adoption in financial services is accelerating, with top use cases in banking (fraud, back office, personalization), insurance (underwriting, risk, back office), and capital markets (back office, compliance, investment analytics).

- New Databricks innovations are empowering teams to move from data ambition to real-world action—no technical expertise required.

- Firms embracing end-to-end AI and data strategies are already outperforming the market—now’s the time to lead, not lag.

If you work in financial services, you know the pressure: more data, more risk, more expectations to deliver results—often with fewer resources and tighter regulations. I’ve been in this industry long enough to see the cycles, but what’s happening now feels different. At this year’s Data + AI Summit, the energy was palpable. And when I look at the latest survey results, featuring insights from 150+ industry leaders, and industry research, it’s clear: we’re not just talking about transformation—we’re living it.

Let’s examine what’s really happening on the ground and how the latest Databricks innovations and market shifts can help us all move from ambition to action.

Driving Revenue: From Personalization to Predictive Analytics

Growth today means knowing your customer better than ever—and acting on that knowledge at scale. Our survey showed that 56% of banks are prioritizing personalization and lead management as their top AI use cases, aiming to deliver tailored experiences that drive new business. In capital markets, 70% are doubling down on investment analytics to make smarter, faster decisions, while 79% of insurers told us that underwriting and actuarial analytics are their main focus for data and AI.

Industry research backs this up: nearly 70% of financial services leaders report that AI has increased revenue by 5% or more, and a growing number are seeing 10–20% revenue boosts. Customer experience and engagement are among the top generative AI use cases delivering ROI, with banks leveraging AI to generate $340 billion in additional operating profits in the U.S. alone.

That’s why I’m genuinely excited about tools like AI/BI Genie (GA), which lets anyone ask questions in plain English and get instant, actionable insights. With Mosaic AI Agent Bricks (Beta), building AI agents for client sentiment or next-best-offer is finally within reach—even for teams without deep technical expertise. And with Lakebase unifying operational and analytical data, you can power real-time insights for everything from personalized offers to smarter risk pricing. I’ve seen how Databricks Apps (GA) and the new Databricks One (Private Preview) interface are helping teams launch new data-driven products faster than ever—no IT bottlenecks, just results.

Protecting the Firm: Risk, Fraud, and Compliance in Real Time

Risk never sleeps, and neither can we. According to our survey, 73% of banks are putting fraud prevention at the top of their agenda. In capital markets, 77% say regulatory compliance is their main focus, while 75% of insurers are zeroing in on risk management.

Industry trends show why: AI-driven fraud detection can cut operational costs by up to 50% and speed detection by as much as 95%. Nearly two-thirds of financial services firms have either implemented or are planning to implement AI for risk management, compliance, and cybersecurity in the next year. The sector is leading all others in AI adoption, with 85% of firms expected to use AI across multiple business functions by the end of 2025.

At the Summit, it was clear: the stakes are higher, but so is our ability to respond. MLflow 3.0 gives us end-to-end model governance, so we can trust the AI decisions we deploy. Mosaic AI Agent Bricks are making it possible to automate compliance checks and fraud detection—saving time, reducing errors, and freeing up our teams for more strategic work. Security upgrades like Serverless Egress Control, Private Link, and Multi-Key Protection mean we can keep sensitive data locked down, even as we scale. And with Unity Catalog (now with full Apache Iceberg™ support), we finally have unified governance across all our data assets, making audits and regulatory reporting a whole lot easier. If you’re thinking about modernizing your data warehouse, Lakebridge (GA) offers a free, AI-powered migration path that’s fast and secure.

Data intelligence reshapes industries

Becoming More Efficient: Automation and Collaboration for the Win

Efficiency isn’t just a buzzword—it’s survival. Our survey found that 60% of banks, 82% of capital markets firms, and 62% of insurers are prioritizing back and middle office automation. Industry research shows that AI-driven automation is delivering up to 40% lower expenses and reducing operational costs by 20–50% for early adopters. Financial institutions are investing in digital transformation at record levels, with nearly 90% of banks increasing IT budgets by at least 10% in 2025.

This year’s announcements felt like a direct response to that need. Lakeflow Designer lets teams build robust data pipelines visually—no code, no bottlenecks. Databricks Lakeflow unifies data engineering, so we can move from ingestion to insight without handoffs or delays. Databricks Clean Rooms are now generally available, making secure, privacy-safe collaboration with partners and regulators a reality. And with Delta Sharing, Databricks Marketplace, and expanded Unity Catalog governance, sharing and monetizing data is finally as easy as it should be. I’m also excited about Declarative Pipelines in Apache Spark™, which are making pipeline development accessible for everyone, not just engineers.

Why This Matters—and What You Should Do Next

The research is clear: financial services is leading the way in AI adoption, with measurable results in revenue, risk management, and efficiency. The window for competitive differentiation is narrowing—firms that orchestrate AI across the business are already outperforming the market, while those that hesitate risk falling behind.

If you’re ready to see what’s possible, connect with your Databricks account executive. Let’s explore how you can leverage new capabilities like Lakebase, Agent Apps, and Unity Catalog Metrics to hit your goals. Book a quick 15-minute strategy call to discuss the latest announcements, see a short demo of Data Intelligence in action, and plan a workshop tailored to your needs.

The future of financial services is here. Let’s build it—together.

Resources

Never miss a Databricks post

What's next?

Data Science and ML

October 1, 2024/10 min read

ICE/NYSE: Unlocking Financial Insights with a Custom Text-to-SQL Application

Product

November 27, 2024/6 min read